Gold price rallies after FOMC statement deemed not too hawkish

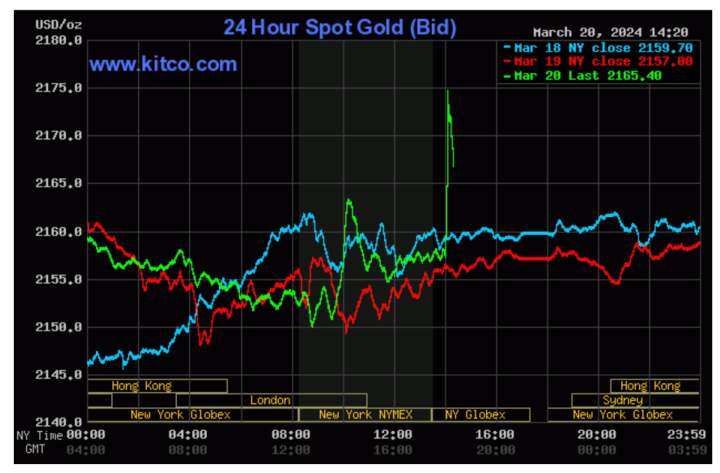

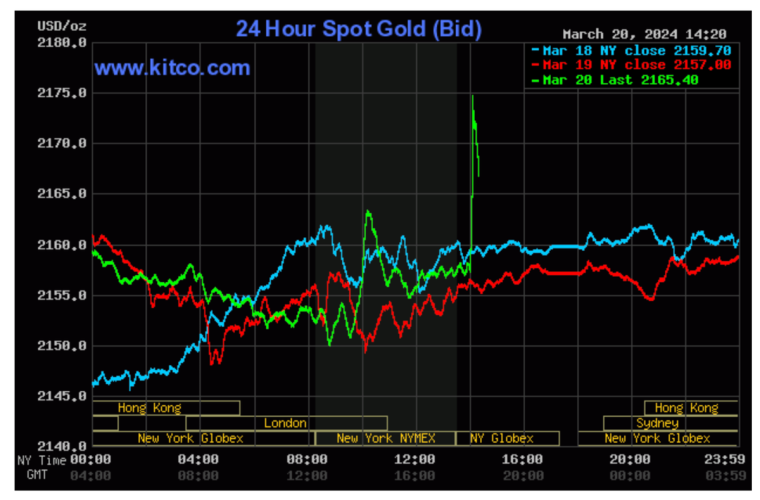

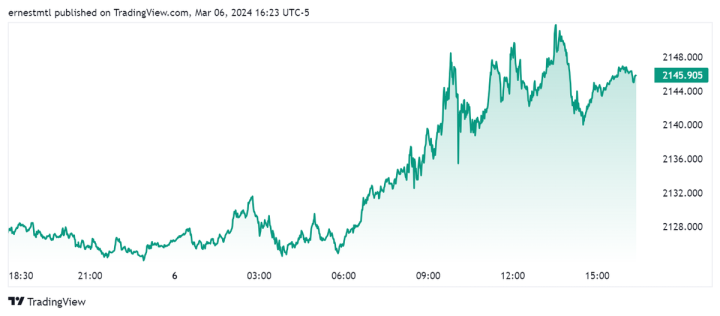

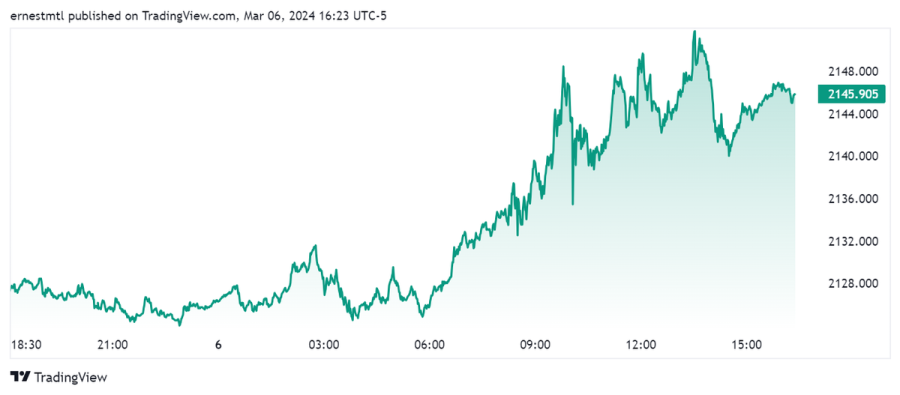

Gold and silver prices are higher and neare daily highs in U.S. trading Wednesday, following a Federal Reserve monetary policy statement that the precious metals bulls saw as price-friendly. April gold was last up $13.30 at $2,173.10. May silver was last up $0.29 at $25.425.

The just-concluded Federal Open Market Committee (FOMC) monetary policy meeting saw the Federal Reserve keep its monetary policy unchanged, as expected. The key Fed Funds interest rate range was kept steady at 5.25% to 5.50%. The FOMC statement seemingly walked a neutral line on policy: not too hawkish and not too dovish. The statement said the U.S. economy is growing and inflation has eased but is still elevated. The statement said no rate cuts will occur until the Fed has more confidence inflation has been tamed. Still, the statement said the Fed sees three interest rat cuts this year. Judging by the reaction of the gold market, traders deemed the FOMC statement as not being too hawkish, and that the Fed appears willing to tolerate slightly higher inflation for longer. Now the marketplace awaits the afternoon press conference from Fed Chairman Jerome Powell. Traders will closely scrutinize Powell’s remarks for clues on the future path and timing of Fed monetary policy.

The key outside markets today see the U.S. dollar index weaker after being higher before the FOMC statement. The USDX had seen a solid rebound from the March low and the bulls have the technical advantage. Nymex crude oil prices are solidly lower and trading around $81.50 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently fetching around 4.3%.

The Bank of England holds its regular monetary policy meeting Thursday.

Technically, April gold futures bulls have the solid overall near-term technical advantage. A four-week-old uptrend is in place on the daily bar chart. A bullish pennant pattern has formed on the daily bar chart, but needs to see an upside breakout very soon to complete the formation. Bulls’ next upside price objective is to produce a close above solid resistance at the contract high of $2,203.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,100.00. First resistance is seen at $2,180.00 and then at $2,190.00. First support is seen at this week’s low of $2,149.20 and then at $2.140.00. Wyckoff's Market Rating: 8.0.

May silver futures bulls have the firm overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at the December high of $26.575. The next downside price objective for the bears is closing prices below solid support at $24.00. First resistance is seen at last week’s high of $25.66 and then at $26.00. Next support is seen at $25.00 and then at $24.50. Wyckoff's Market Rating: 7.0.

May N.Y. copper closed down 20 points at 407.25 cents today. Prices closed nearer the session high. The copper bulls have the solid overall near-term technical advantage. Prices are in a steep five-week-old uptrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 425.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 400.00 cents. First resistance is seen at today’s high of 408.95 cents and then at Tuesday’s high of 413.65 cents. First support is seen at today’s low of 402.70 cents and then at 400.00 cents. Wyckoff's Market Rating: 7.5.

Kitco Media

Jim Wyckoff

Tim Moseley

.jpeg)

.png)