Gold bugs crow as the yellow metal breaks through $2,500 per ounce to set fresh all-time highs

Gold prices hit new all-time highs in both spot and futures markets on Friday after weaker-than-expected U.S. housing data stoked worries that downside risks to growth are rapidly overshadowing the upside risks of inflation that have dominated the attention of investors and central banks for the last two years.

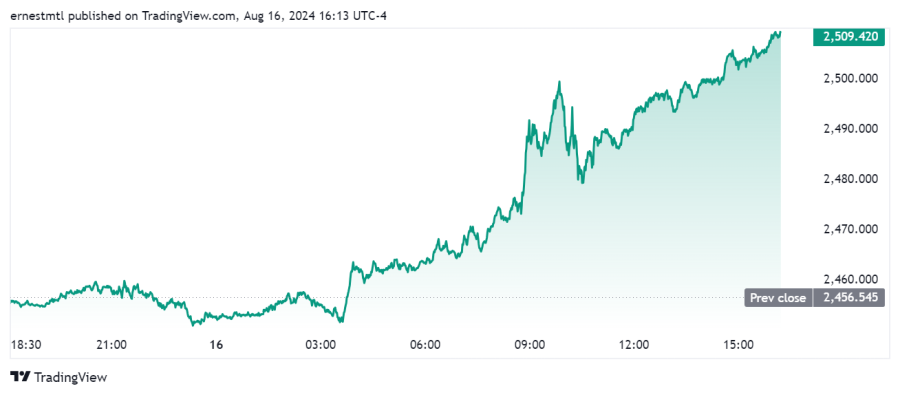

Spot gold first breached the $2,500 per ounce level shortly before 10 am EDT, just half an hour into the North American trading session and less than 90 minutes after the housing data was released.

After pulling back as low as $2,479 per ounce, the yellow metal began its steady march higher once again, and broke definitively above $2,500 just after 2:30 pm EDT.

At the time of writing, spot gold last traded at $2,509.42 for a gain of 2.15% on the session.

“Gold has been on an unstoppable run since October last year, surging from near the $1,800 level to score back-to-back all-time record highs – not once, not twice, but on multiple occasions this year,” wrote Phil Carr, Head of Trading at The Gold & Silver Club on FXEmpire. “The precious metal is up over 26% since mid-February. But here’s where it gets even better – Gold prices have now chalked up a whopping gain of more than 38% since October.”

Carr also noted the historically strong correlation between U.S. government debt and gold prices.

“Conclusive evidence shows during the period U.S national debt has ballooned from 5 trillion to 35 trillion dollars – Gold prices have risen by 8x since 2000,” he said. “But here’s where things really start to get interesting. If history repeats itself, Gold prices could reach $5,000 an ounce when U.S national debt hits the 70 trillion dollar mark.”

Others saw the yellow metal’s strength as an indication of political as well as economic concerns.

“Gold hits 2500 for the first time in history ahead of Kamala's central planning unveil that will usher in even more runaway inflation,” Zerohedge wrote in an X post.

CryptoRover noted the correlation between the prices of gold and Bitcion.

Longtime gold bull and crypto critic Peter Schiff wasted no time weighing in on the precious metal’s performance, and what it says about U.S. monetary policy.

“Powell claims he's data-dependent,” Schiff wrote in an X post. “Alan Greenspan, who once held his job, said the most important data point on #inflation is the gold price. He said if gold is breaking down, monetary policy is too tight. If it's breaking out, it's too loose. #Gold just broke out above $2,500!”

And veteran mining magnate Frank Giustra also chimed in on Friday as gold blew through resistance at $2,500.

“For the most part, US mainstream Media chooses to ignore gold hoping it will just go away,” he said. “Meanwhile the rest of the world is loading up at record numbers. A rising gold price is a threat to the narrative that all is ok with the fiat currency system.”

Kitco Media

Ernest Hoffman

Tim Moseley