US dollar reserves drop 14% since 2002 as BRICS and gold challenge hegemony

The decline of the U.S. dollar (USD) as the world’s reserve currency has been a popular topic of conversation for years – especially in the wake of the global financial crisis (GFC) of 2007-2008 – and while talks of its impending demise may be overblown, data provided by the Atlantic Council shows that the world is indeed utilizing the USD significantly less than at the turn of the century.

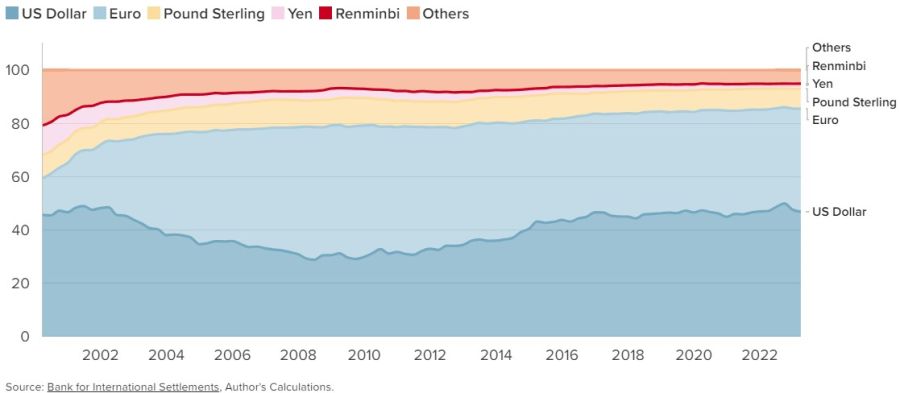

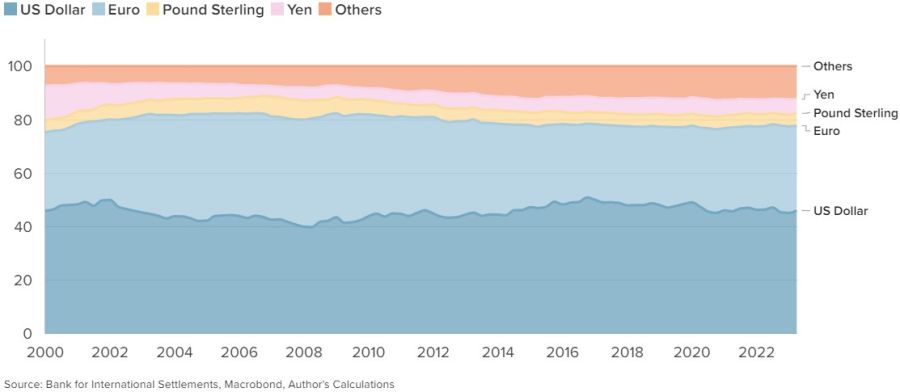

According to the Atlantic Council’s Dollar Dominance Monitor, the share of the USD in global reserves stood at 58% in 2024, a 14% decline from 2002 when it accounted for 72% of global reserves.

“The US dollar has served as the world’s leading reserve currency since World War II,” the report said. “Today, the dollar represents 58 percent of the value of foreign reserve holdings worldwide. The euro, the second-most-used currency, comprises only 20 percent of foreign reserve holdings.”

“But in recent years, and especially since Russia’s invasion of Ukraine and the Group of Seven (G7)’s subsequent escalation in the use of financial sanctions, some countries have been signaling their intention to diversify away from dollars,” researchers at the Atlantic Council said.

The pace of de-dollarization has picked up in recent years, and the researchers pointed to one development that has hastened this trend: the growth of BRICS.

“Over the past twenty-four months, the members of BRICS (a grouping of Brazil, Russia, India, China, and South Africa that recently added Egypt, Ethiopia, Iran, and the United Arab Emirates; Saudi Arabia is considering joining) have been actively promoting the use of national currencies in trade and transactions,” the report said. “During this same time, China has been expanding its alternative payment system to its trading partners and seeking to increase international usage of the renminbi.”

“The project identifies the BRICS as a potential challenge to the dollar’s status due to the individual members’ signal of intent to trade more in national currencies and the BRICS’ growing share of global GDP,” they added. “Among the BRICS currencies, the renminbi has the highest potential of competing with the dollar as a trade and reserve currency.”

Two key indicators identified by the report that highlight the growing strength of the alternative financial infrastructure China is building are “China’s swap lines with the BRICS countries and membership in China’s Cross-Border Interbank Payment System (CIPS),” they wrote.

The researchers found that between June 2023 and May 2024, “CIPS added sixty-two direct participants and now comprises 142 direct and 1,394 indirect participants.”

“SWIFT is still by far the dominant player, with more than 11,000 connected banks,” they noted. “Since the direct CIPS participants could clear transactions without relying on SWIFT or the dollar, traditional indicators of renminbi use may be undercounting the actual value.”

While China has been making strides in adding partners to CIPS, the researchers said “The dollar’s role as the primary global reserve currency is secure in the near and medium term.”

“The dollar continues to dominate foreign reserve holdings, trade invoicing, and currency transactions globally,” they said. “All potential rivals, including the euro, have a limited ability to challenge the dollar in the immediate future.”

As for the development of an intra-BRICS payment system, the Atlantic Council found that negotiations around such a system “are in the early stages, but the members have reached bilateral and plurilateral agreements with one another, with a focus on cross-border wholesale central bank digital currency (CBDC) and currency swap agreements.”

“These agreements are likely difficult to scale due to regulatory and liquidity issues but may form the basis for a currency exchange platform over time,” the researchers said.

While China poses the single greatest threat to the standing of the USD, its recent struggles, including a collapsing real estate market, have seen the renminbi lose some of the ground it had gained on the USD in foreign currency reserves.

“In the last quarter of 2023, the share of renminbi in global foreign currency reserves dropped to 2.3% from the peak of 2.8% in 2022, despite Beijing’s active support of renminbi liquidity through swap lines,” the report said. “Reserve managers might be perceiving the renminbi as a geopolitically risky currency because of concerns about China’s economy, Beijing’s position on the Russia-Ukraine war, and increased tensions with the US and G7.”

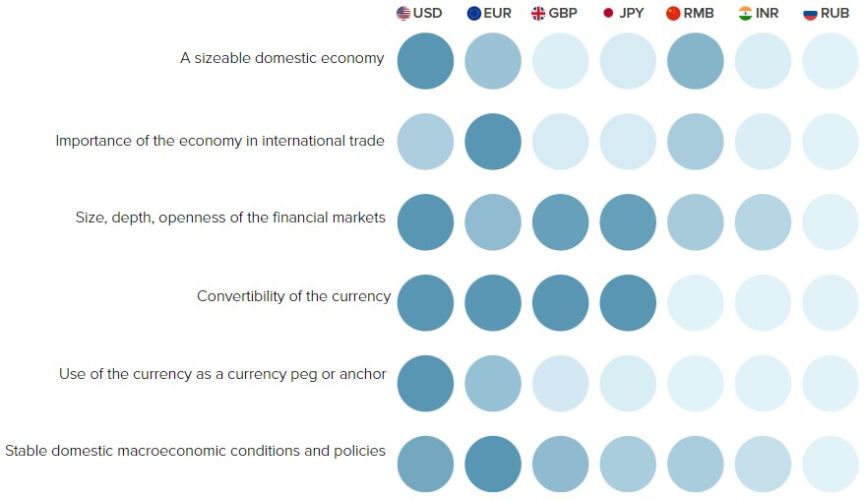

Based on the six “essential qualities of a reserve currency” identified by the Atlantic Council, the euro is the most suited to become a reserve currency behind the USD, followed by the renminbi.

“The dollar and euro collectively form nearly 80 percent of global foreign exchange reserves,” the report said. “While the dollar-share is on a very modest long-term declining trend, its lost share has been distributed among several currencies.”

The dollar also accounts for “nine out of every ten currency transactions” on the international market, which “reflects the dollar's ‘vehicle’ or intermediary role in forex markets which minimizes transaction costs for traders and reinforces the dollar's centrality in financial networks,” the authors noted.

“Since the currency of settlement and currency of invoicing are often closely tied to each other, the dollar’s use as a medium of exchange is linked to its status as the global unit of account,” said Martin Mühleisen, Senior Fellow at the Atlantic Council.

The dollar also plays a substantial role in the international debt markets. “Debt securities provide a channel for the private sector to store value,” the report said. “The dollar, euro, and pound together form more than 90 percent of outstanding international debt securities. Following the 2008 Global Financial Crisis, the dollar recovered the share that it lost in the 2000s.”

The dollar and euro are also the workhorses powering the international banking system.

“Approximately 45 percent of banking claims across national borders or denominated in a foreign currency are held in dollars,” the authors said. “The dollar remains the most important currency in the international banking system, partly as a result of its role as a vehicle currency.”

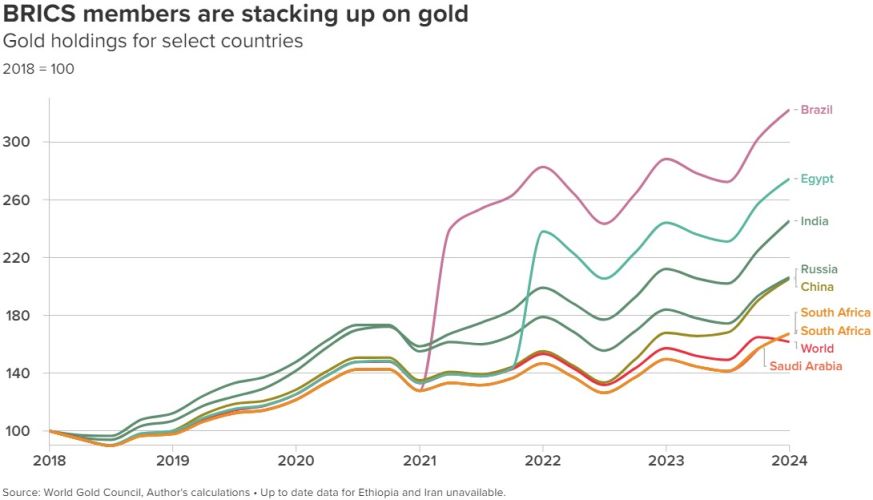

While other currencies have struggled to gain ground against the USD, the Atlantic Council noted that there is one commodity that has gained favor with BRICS members: gold.

“Emerging markets have driven the surge in recent gold purchases,” the report said. “Since 2018, all members of BRICS have increased their gold holdings at a faster rate than the rest of the world, despite its historically high prices.”

“Many advanced economies accumulated large gold reserves over centuries and retained them over the 20th century to maintain the gold standard following the end of the Second World War,” the authors said. “Recent surveys suggest that advanced economies are now planning to increase their gold holdings to hedge against the risks of economic shocks. This will further raise global demand for gold over the next few years.”

“Emerging markets tend to keep the majority of their reserves in foreign exchange, but have steadily increased the share of gold,” they added.

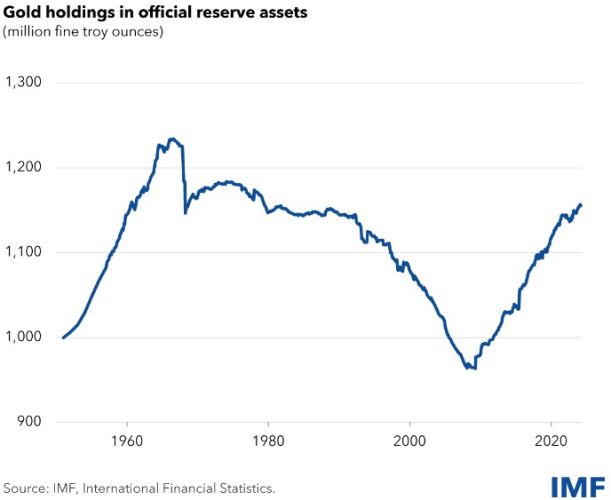

Getting into the finer details, the authors noted that gold’s share in international reserve portfolios “began rising in 2019 and accelerated following the onset of the pandemic, rising from about 10% to nearly 16% today. Central banks now collectively hold more than 35,000 tonnes of gold, nearly 20% of all gold ever mined.”

Reasons for emerging market central banks purchasing gold include the fact that the precious metal “provides options in the face of geopolitical risk; provides a hedge against inflation; is considered a safe haven asset, particularly in moments of broader economic downturns as it has held its value over centuries and does not bear any credit risk; and it provides a hedge against dollar value swings,” the authors said.

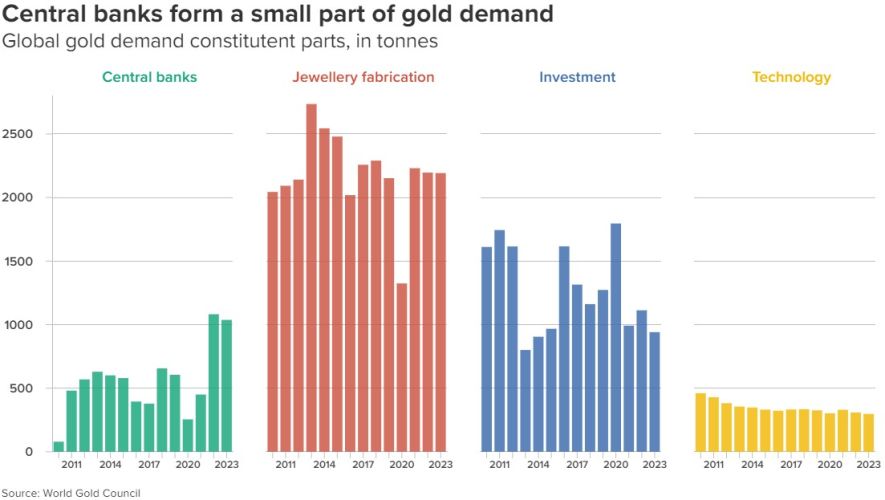

Jewelry fabrication was cited as the primary driver in demand for gold.

“The metal is also used as an investment tool by non-institutional agents in the form of bars, coins, and ETFs,” the report said. “Due to its electrical conductivity, malleability, and corrosion resistance, gold is also used in electronics, industrial equipment, and dentistry.”

“Central bank demand for gold has traditionally been dwarfed by other demand drivers of the metal, but central banks have boosted their demand since 2022,” they noted. “This upswing coincides not only with Russia's invasion of Ukraine, but also with a spike in inflation around the world, dollar strength, and heightened geopolitical uncertainty.”

“Nearly a third of all central banks plan on increasing their gold reserves in 2024,” the authors concluded. “While the euro was once considered a competitor to the dollar’s international role, it continues to lag far behind and is weakening as an attractive reserve currency. The 2022 sanctions on Russia signaled to reserve managers that the euro exposed them to similar geopolitical risks as the dollar. Those looking to de-risk away from the dollar have turned to gold.”

A June report from the IMF corroborated the report from the Atlantic Council, finding that there is an “ongoing gradual decline in the dollar’s share of allocated foreign reserves of central banks and governments.

“Strikingly, the reduced role of the US dollar over the last two decades has not been matched by increases in the shares of the other ‘big four’ currencies – the euro, yen, and pound,” the report added. “Rather, it has been accompanied by a rise in the share of what we have called nontraditional reserve currencies, including the Australian dollar, Canadian dollar, Chinese renminbi, South Korean won, Singaporean dollar, and the Nordic currencies.”

“These nontraditional reserve currencies are attractive to reserve managers because they provide diversification and relatively attractive yields, and because they have become increasingly easy to buy, sell and hold with the development of new digital financial technologies (such as automatic market-making and automated liquidity management systems),” the IMF explained.

The IMF report also cited an increasing appetite for gold by central banks following the financial sanctions the U.S. imposed on Russia after it invaded Ukraine.

“[F]inancial sanctions, when imposed in the past, induced central banks to shift their reserve portfolios modestly away from currencies, which are at risk of being frozen and redeployed, in favor of gold, which can be warehoused in the country and thus is free of sanctions risk,” the report said. “That work also showed that the demand for gold by central banks responded positively to global economic policy uncertainty and global geopolitical risk.”

“These factors may lie behind the further accumulation of gold by a number of emerging market central banks,” they added. “Before making too much of this trend, however, it is important to recall that gold as a share of reserves still remains historically low.

“In sum, the international monetary and reserve system continues to evolve,” the IMF concluded. “The patterns we highlighted earlier – very gradual movement away from dollar dominance, and a rising role for the nontraditional currencies of small, open, well-managed economies, enabled by new digital trading technologies – remain intact.”

Kitco Media

Jordan Finneseth

Tim Moseley