Trump 2.0 could drive global investors to gold, both silver and gold prices will benefit from trade wars – Heraeus

Trump 2.0 could drive global investors to gold, both silver and gold prices will benefit from trade wars – Heraeus teaser image

The prospect of a Trump victory in November could push investors around the world into the yellow metal, while both gold and silver prices stand to benefit from tariffs and trade disputes, according to precious metals analysts at Heraeus.

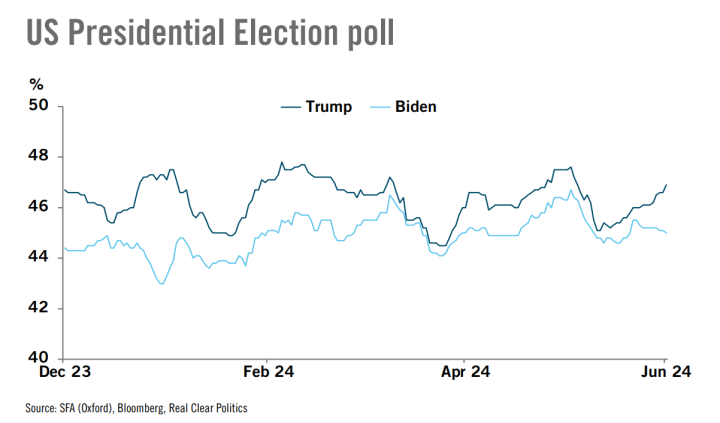

In their latest precious metals report, Heraeus suggested that the economic policies of a second Trump administration could drive global investors into gold. “The upcoming 5 November presidential election will set the United States on two fundamentally different paths, depending on the outcome,” the analysts wrote. “The more unpredictable former president and current Republican candidate, Donald Trump, may introduce several economic policies that could lead to significant market shocks, geopolitical risks and rising inflation. Trump currently maintains an edge over Biden in the polls – 46.9% vs. 45.0%.”

.jpeg)

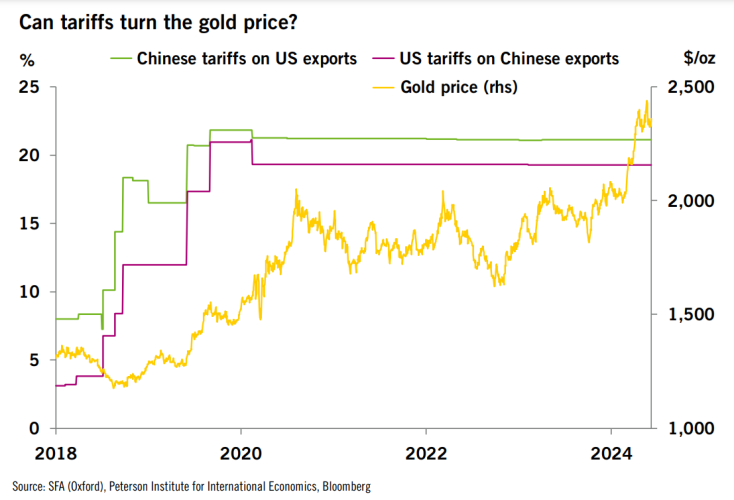

Heraeus pointed out that a renewed trade war could escalate tensions between the U.S. and China and could hurt both the U.S. and global economies.

“While the Biden administration preserved many of Trump’s China tariffs and raised tariffs on only a small basket of Chinese cleantech imports, a second Trump administration could escalate the trade war unprecedentedly,” they said. “Trump has proposed two significant trade policy agendas: imposing a 10% across-the-board tariff on all imports from all countries and imposing tariffs of 60% or more on all Chinese imports. Although the legal feasibility of these measures is still in question, Trump’s first administration demonstrated the possibility of launching a trade war on China by invoking a loophole clause from an old statute – the 1974 Trade Act. A Peterson Institute paper found that these proposed tariffs could lead to an economic loss of 1.8% of US GDP, and significantly raise inflation. This assessment does not account for the almost guaranteed retaliatory tariffs from China and other countries.”

The analysts noted that the 2018-2020 U.S.-China trade war coincided with rising gold prices. “Gold surged during this period as the prolonged negotiations, coupled with tariff and geopolitical escalations, drove investors to seek gold as a safe-haven asset despite a rate-hiking environment until mid-2019,” they said. “Gold’s appreciation closely correlated with the tariff increases which served as a meaningful indicator of US-China tensions (see the chart). Global ETF holdings increased from end-2017’s 71 moz to end-2019’s 86 moz, and US ETF holdings grew from 37 moz to 44 moz.

.png)

Heraeus worries that Trump could also undermine the independence of the Federal Reserve, as his first presidency saw public attacks on Fed Chair Jerome Powell’s rate hikes.

“Unofficial proposals from the Trump campaign team include steps to undermine the Fed’s independence and potentially removing Powell prematurely,” they said. “Trump could replace Powell after his term ends in 2026 with a dovish candidate. Additionally, Trump could appoint multiple governors to the Federal Open Market Committee (FOMC) who would favour looser monetary policies.”

“A more dovish FOMC would expedite rate cuts and loosen inflation control, weakening the dollar and increasing investors’ demand for gold,” they pointed out. “Any manoeuvres extending executive authority over the Fed could shake market confidence in US monetary policies, further boosting gold prices.”

Moving to the Asian environment for precious metals, the analysts noted that India continues to see robust demand for gold. “Gold imports to India remained strong in May, reaching ~44.5 tonnes, signalling above-average levels of gold purchasing,” they said. “Although May’s imports were slightly lower than last year’s 58.5 tonnes, which marked a particularly high year for India’s gold consumption, high gold imports around mid-year typically translate to robust jewellery production for festivals in the third quarter.”

The analysts noted that India accounted for 95.5 tonnes of jewellery demand in Q1 of 2024, a 4% annual increase. “This is only half of China’s 184.2 tonnes of consumption in the same period (-6% year-on-year),” they wrote. “India’s jewellery consumption makes up 20% of the world’s total, and it is the second-largest consumer market for gold. Resilient demand year-to-date partly offsets the decrease of jewellery demand in China.”

They also pointed out that India’s central bank has seen a net inflow of 24.1 tonnes of gold in 2024, which already surpasses last year’s total. “The Indian central bank has been the third-largest gold purchaser amongst its peers this year, behind Turkey and China,” they said.

Gold prices remained in their recent channel between $2,300 and $2,340 during the first two days of the week, with spot gold last trading at $2,330.80, essentially flat on the session.

Turning to silver, Heraeus believes the expansion of the U.S. solar manufacturing industry combined with increasing barriers to trade could serve to boost domestic silver demand.

“In Q1’24, the US added 11 GW of new solar module manufacturing capacity, driven by substantial investments spurred by the Inflation Reduction Act,” the analysts noted. “Thanks to rapid solar deployment in every major region, silver demand from solar PVs is expected to reach a consecutive record of more than 230 moz this year (source: The Silver Institute), equal to ~19% of total global use of silver."

And solar is not the only area of silver demand benefiting from the green energy transition, they noted. “Expansion of EV charging infrastructure is also an area of focus for government subsidies in the US,” they said. “Since January 2021, the number of public EV chargers has grown by 55% to ~175,000 across the country (source: Joint Office of Energy and Transportation). The rollout of large-scale electric infrastructure requires the use of silver in connectors and various components.”

“Moreover, the US is expected to announce several tariffs aimed at curbing Chinese circumvention practices, such as evading tariffs by setting up PV manufacturing plants in Southeast Asia,” Heraeus wrote. “These trade barriers could segment the market and put pressure on the US government to expand domestic demand, creating a bullish outlook for silver’s industrial uses.”

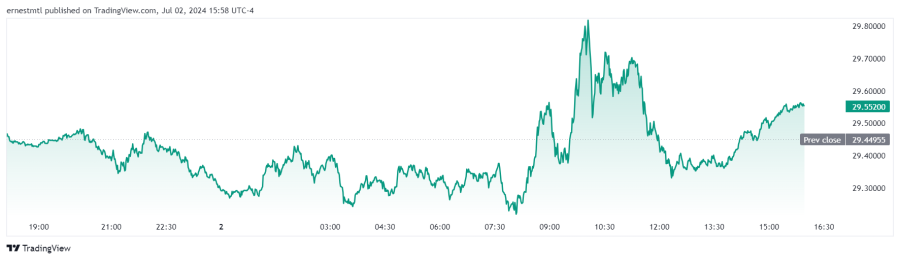

Silver prices have seen mildly positive momentum this week, with spot silver hitting a session high of $29.823 shortly after 10 am EDT on Tuesday, and last trading at $29.552 for a gain of 0.35% on the daily chart.

Kitco Media

Ernest Hoffman

Tim Moseley