Gold price remains stuck this week even as inflation gives the Fed some breathing room to cut rates

Gold investors might want to get comfortable because gold is in a holding pattern that doesn't appear to be on the verge of breaking out anytime soon. However, despite the neutral price action, analysts still appear to be optimistic as long-term fundamentals continue to support the price.

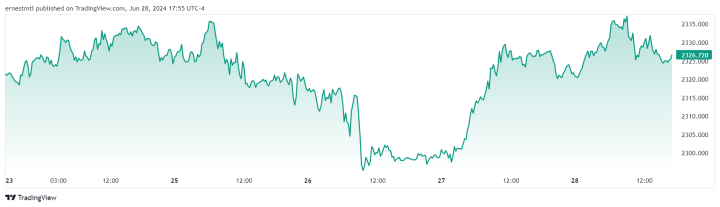

Gold continues to trade in a fairly narrow range with solid support at $2,300 and initial resistance at $2,350. Analysts also note that there is broader resistance at the $2,400 level. August gold futures, last traded at $2,342 an ounce, are looking to end the week up roughly 0.5% from last Friday.

"Gold is in a holding pattern, but the risks are to the upside," said Michele Schneider, Chief Strategist of MarketGauge.com. "Inflation is not going away, geopolitical tensions are not easing, and government deficits are growing. This is providing solid support for gold."

A clear message from a growing chorus of analysts is that gold remains in a strong uptrend as long as prices hold support above $2,300 an ounce.

Although gold could continue to be a boring trade in the early months of summer, Schneider said that she could see it breaking out before September. She explained that the Federal Reserve is clearly stuck and if they don't start to lower rates, even as inflation remains elevated, they risk driving the economy into a recession.

"I don't think the Fed will change its stance before the next meeting," she said. "But the question remains, at what point will they be forced to do something and just how far behind the eight-ball they will be when they finally act?"

Naeem Aslam, Chief Investment Officer at Zaye Capital Markets, said that he also remains optimistic for gold, even as prices continue to consolidate.

"Inflation is as low as it can be given the circumstances, and the Fed really needs to move away from its current stance and start giving signals to the market that an interest rate cut is coming. This is because if they don't do that, sentiment in the market would become a lot worse—one evidence of this is already here in terms of pending home sales data and the default levels that we see in the commercial market. So we think, in the absence of assurance, risk could actually increase in the market and it could favor the price of gold," he said. "On the other hand, if the Fed does give a signal for a rate cut, we would see an upward movement in the gold price due to the weakness in the dollar index."

Aslam's comments come after the U.S. core Personal Consumption Expenditures Index showed benign inflation pressures rising in line with expectations. In the last 12 months, the Federal Reserve's inflation gauge rose 2.6%, its slowest annual gain in more than three years.

Although inflation hasn't reached the Federal Reserve's target of 2%, some analysts have said that it is close enough to signal a rate cut in September.

David Morrison, Senior Market Analyst at Trade Nation, said that after two months of consolidation, gold's price action looks attractive, especially as inflation pressures look to ease further.

"Chart-wise, gold has now been consolidating for the last month, and is down 6% from all-time highs. To me, this looks like a setup from which prices will eventually head higher. I certainly wouldn't be surprised to see gold back above $2,350 sometime in July," he said. "Although, we may see some caution creep in next week with Thanksgiving on Thursday and Friday's Non-Farm Payroll update."

However, other analysts also note that gold still doesn't have an "all-clear signal" and that could only come after disappointing employment numbers next week.

Lukman Otunuga, Manager of Market Analysis at FXTM, said that the market is on breakout watch between $2,290 and $2,370 an ounce and is waiting for the catalyst to trigger the next directional move. He added that right now, the market is balanced to go either way.

"After initially being supported by expectations over lower U.S. interest rates, geopolitical tensions, and central bank buying in H1, bulls could be running out of steam. While the U.S. election uncertainty may translate to increased volatility, it's all about what actions the Fed takes in the second half of 2024," he said. "This directs our attention toward the NFP report in the week ahead, which may shape gold's outlook for July. Traders are currently pricing in a 75% probability of a 25 basis point cut in September with a move fully priced in by November. Any major shifts to these bets could support bulls or bears."

Economic data to watch this week:

Monday: ISM Manufacturing PMI

Tuesday: Eurozone CPI flash estimates, JOLTS Job Openings, ECB President Christine Lagarde and Federal Reserve Chair Jerome Powell will be speaking at a central bank conference in Portugal

Wednesday: ADP Employment, Weekly Jobless Claims, ISM Services PMI; Minutes from the FOMC June meeting

Friday: U.S. Nonfarm Payrolls Report

Kitco Media

Neils Christensen

Tim Moseley