People are coming to the view that rates are less likely to go down to their pre-pandemic levels,’ Fed Chair Powell tells reporters

Federal Reserve Chair Jerome Powell used his post-FOMC press conference to try to reassure markets that even though the central bank’s latest data showed inflation projections rising and the number of expected rate cuts falling, the committee’s policy bias was still tilted toward easing. However, he also suggested people were getting used to the idea that interest rates would not return to pre-pandemic levels, signaling that the Fed may be preparing markets for a higher neutral rate.

Powell was asked at the outset whether FOMC members expected no further progress on inflation this year, given that the new Core PCE forecast was 2.8% by the year-end, and it's already at 2.75%.

“What's going on there is that we had very low readings in the second half of last year, June through December really, and we're now lapping those,” he said. “As you go through the 12-month window, a very low reading drops out and the new reading gets added to the 12-month window.”

“It's just a slight element of conservativism, that we're assuming a certain level of incoming monthly PCE and core PCE numbers,” he continued. “We're assuming good but not great numbers, and if you put that on top of where we are now, you get a very slight increase in the 12-month reading.”

“Now, do we have high confidence that that's right? No,” Powell said. “It's just a conservative way for forecasting things. If we were to get more readings like today's reading, then of course that wouldn't be the case.”

The Fed Chair was also asked if two or three more inflation readings like the one markets saw this morning would make a September rate cut possible.

“I talk to all of the other participants on the FOMC every cycle, and we talk about their summary of economic projections [SEP], and their dot plot, and everything,” he said. “What I hear and see is that people are looking at a range of plausible outcomes, and in many cases, they're thinking ‘I can't really distinguish between two of these, they're so close, these are very close calls.’ But we ask them to write down the most likely one, so they do.”

“As you've said, 15 of the 19 are clustered around one or two [cuts],” Powell went on. “I look at all of them as plausible, so I think that does tell you what the committee thinks. But what everyone agrees on is it's going to be data-dependent. They're not trying to send a strong signal that this is what I think is the right thing. It's just what they think at a given point in time, subject to data.”

“In terms of future meetings, we don't make decisions about future meetings until we get there,” he added. “We want to gain further confidence. Certainly more good inflation readings will help with that.”

Powell was asked whether any FOMC members had changed their interest rate projections after the 8:30 am CPI release.

“When there's an important data print during the meeting, first day or second day, what we do is we make sure people remember that they have the ability to update, we tell them how to do that, and some people do, some people don't,” he said. “Most people don't, and I'm not going to get into the specifics. But you have the ability to do that, so that what's in the SEP actually does reflect the data that we got today, to the extent you can reflect it in one day.”

“I think we'll see PPI tomorrow, we'll know more about the PCE reading as the month goes on,” Powell added.

The Fed Chair was also asked whether the labor market is more vulnerable to higher rates now that many of the post-pandemic imbalances have eased.

“By so many measures, the labor market was overheated two years ago, and we've seen it gradually move back into much better balance between supply and demand,” Powell replied. “So what have we seen? We've seen labor force supply come up quite a bit through immigration and through recovering participation. On the demand side, we've seen quits moving down, we've seen job openings moving down, we've seen wage increases moving from very, very high levels a couple of years ago back down to more sustainable levels.”

Powell acknowledged that unemployment has risen by about 0.6% in a little over a year, but he characterized that as “very, very gradual,” and said 4% unemployment remains historically low. “We watch […] the labor market very carefully, and that's what we see,” he said. “We see gradual cooling, gradual moving toward better balance. We're monitoring it carefully for signs of something more than that, but we really don't see that.”

Chair Powell was then asked about the significant shift in the SEP since the March meeting, with the latest version showing a much shallower path of rate cuts this year.

“The big thing that changed was the inflation forecast moved up several tenths before the end of the year,” he said. “We had really good inflation data in the second half of last year, then a pause in progress in the first quarter. And what we took away from that was that it's probably going to take longer to get the confidence we need to begin to loosen policy.”

“The sense of that is that rate cuts that might have taken place this year, take place next year,” he continued. “There are fewer rate cuts in the median this year but there's one more next year. So really, if you look at year-end 2025 and '26, you're almost exactly where you would have been, just it's moved later because of that progress.”

The Chair was then asked about the SEP’s long run interest rate forecast, which also moved higher, and whether this indicated that rates may not be restrictive enough.

“You're right, it did move up,” he replied. “I just think people are coming to the view that rates are less likely to go down to their pre-pandemic levels, which were very low by recent history measures. Now, we can't really know that. Ultimately, we think that things like the neutral rate are driven by longer run, slow moving forces.”

The Fed Chair added that as time has gone on, everyone is wondering just how restrictive the policy has become. “My answer has been that policy is restrictive,” he said. “The question of whether it's sufficiently restrictive is going to be one we know over time. I think the evidence is pretty clear that policy is restrictive and is having the effects that we would hope for.”

Powell was then asked to explain why the central bank would cut at all this year when the growth forecast doesn't predict any slowdown in 2024, the unemployment forecast doesn’t show significant weakening of the labor market, and the latest inflation forecasts average out to no change.

“We think policy is restrictive and we think ultimately that if you just set policy at a restrictive level, eventually you'll see real weakening in the economy,” Powell replied. “That's always been the thought, that since we raised rates this far, we've always been pointing to cuts at a certain point. Not to eliminate the possibility of hikes, but no one has that as their base case, no one on the committee does.”

Powell then addressed signs that consumer-level inflation pressures were easing, saying that there were still problematic areas.

“It's true that inflationary pressures have come down, but we're still getting high inflation readings,” he said. “In some parts of non-housing services you see elevated inflation still, and it could be to do with wages.”

Powell added that goods prices have fluctuated. “There's been a surprising increase in import prices on goods which is kind of hard to understand, and we've taken some signal from that,” he said. “Wages are still running, I would say, above a sustainable path, which would be that of trend inflation and trend productivity. We haven't thought of wages as being the principal cause of inflation, but at the same time, getting back to 2% inflation is likely to require a return to a more sustainable level, which is somewhat below the current level of increases.”

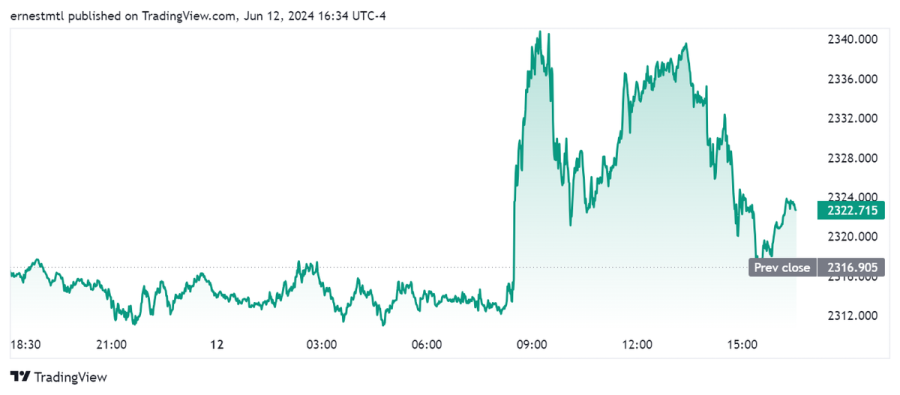

Gold prices trended lower throughout Powell’s press conference, with spot gold sliding from $2,332.34 when he began speaking to $2,317.29 by the time he finished taking questions.

Kitco Media

Ernest Hoffman

Tim Moseley