Gold, silver up a bit in quieter, two-sided trading

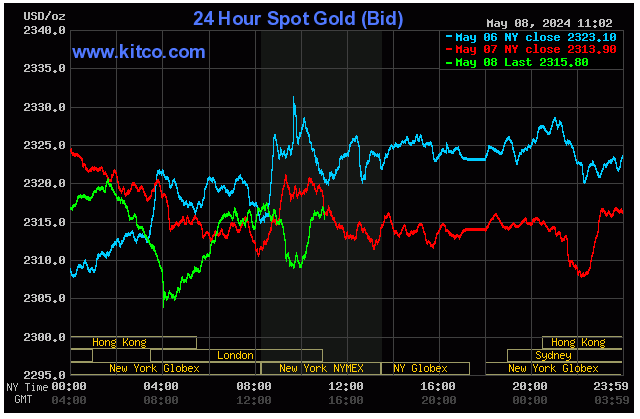

Gold and silver prices are just a bit higher in midday U.S. trading Wednesday, on some more backing and filling on the charts amid a lack of major, fresh fundamental news in the marketplace at mid-week. Traders are awaiting some fresh markets-moving fundamental news. June gold was last up $1.80 at $2,326.10. July silver was last up $0.156 at $27.70.

Reports said China’s central bank continues to stock up on gold reserves, adding 1.9 metric tons in April, making it 18 straight months for expanding its reserves. However, the reports said the pace of China gold buying has slowed.

The key outside markets today see the U.S. dollar index slightly up. Nymex crude oil prices are firmer after hitting a nearly two-month low overnight and are trading around $78.75 a barrel. The yield on the benchmark 10-year U.S. Treasury note is fetching 4.488%.

Technically, June gold futures bulls have the overall near-term technical advantage. A price downtrend is still in place on the daily bar chart, however. Bulls’ next upside price objective is to produce a close above solid resistance at $2,400.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,250.00. First resistance is seen at this week’s high of $2,341.90 and then at $2,350.00. First support is seen at today’s low of $2,311.40 and then at $2,300.00. Wyckoff's Market Rating: 6.5.

July silver futures bulls have the overall near-term technical advantage. A price downtrend on the daily bar chart has stalled. Silver bulls' next upside price objective is closing prices above solid technical resistance at $29.00. The next downside price objective for the bears is closing prices below solid support at last week’s low of $26.255. First resistance is seen at $28.00 and then at $28.25. Next support is seen at today’s low of $27.24 and then at $27.00. Wyckoff's Market Rating: 6.0.

July N.Y. copper closed down 645 points at 454.10 cents today. Prices closed near mid-range today. The copper bulls have the solid overall near-term technical advantage. Prices are in a three-month-old uptrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 480.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 440.00 cents. First resistance is seen at 460.00 cents and then at this week’s high of 464.50 cents. First support is seen at 450.00 cents and then at last week’s low of 446.60 cents. Wyckoff's Market Rating: 7.5

Kitco Media

Jim Wyckoff

Tim Moseley