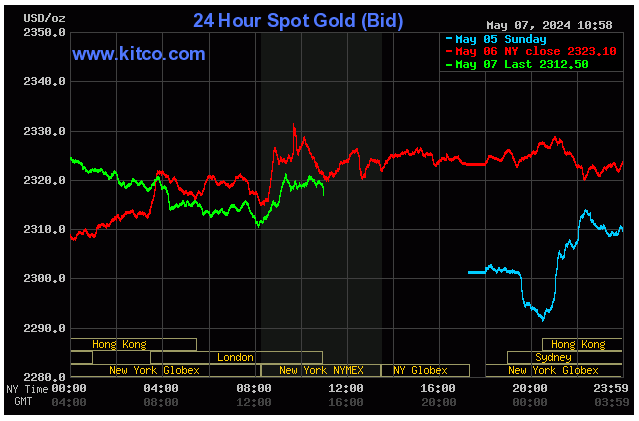

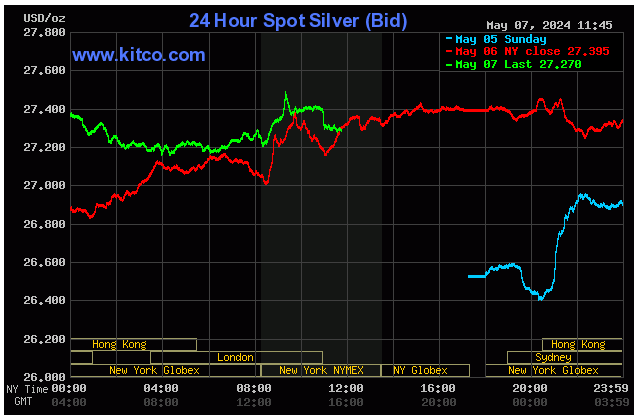

Modest downside corrections for gold, silver

KGold and silver prices are posting mild losses in subdued midday U.S. trading Tuesday, on corrective pullbacks after Monday’s decent gains. A firmer U.S. dollar index on this day is a mildly bearish “outside-market” force working against the precious metals market bulls. June gold was last down $10.00 at $2,321.30. July silver was last down $0.089 at $27.525.

Risk appetite was not dented much Tuesday, at least not yet, after Israel said it had taken control of part of the southern city of Rafah in the Gaza strip near the Egyptian border. The stepped-up Israeli military operations in Gaza come as there had been better hopes a ceasefire between Israel and Hamas might be imminent.

The key outside markets today see the U.S. dollar index modestly higher. Nymex crude oil prices are near steady and trading around $78.50 a barrel. The yield on the benchmark 10-year U.S. Treasury note is fetching 4.429%.

.png)

Technically, June gold futures bulls have the overall near-term technical advantage. A price downtrend is still in place on the daily bar chart, however. Bulls’ next upside price objective is to produce a close above solid resistance at $2,400.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,250.00. First resistance is seen at this week’s high of $2,341.90 and then at $2,350.00. First support is seen at $2,300.00 and then at last week’s low of $2,285.20. Wyckoff's Market Rating: 6.5.

July silver futures bulls have the overall near-term technical advantage. A price downtrend on the daily bar chart has stalled. Silver bulls' next upside price objective is closing prices above solid technical resistance at $29.00. The next downside price objective for the bears is closing prices below solid support at last week’s low of $26.255. First resistance is seen at today’s high of $27.77 and then at $28.00. Next support is seen at $27.25 and then at $27.00. Wyckoff's Market Rating: 6.0.

July N.Y. copper closed down 45 points at 461.05 cents today. Prices closed near mid-range today. The copper bulls have the solid overall near-term technical advantage. Prices are in a three-month-old uptrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 480.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 440.00 cents. First resistance is seen at today’s high of 464.50 cents and then at the April high of 469.45 cents. First support is seen at this week’s low of 453.55 cents and then at 450.00 cents. Wyckoff's Market Rating: 7.5.

Kitco Media

Jim Wyckoff

Tim Moseley