Gold price action driven by conflicting cyclical and structural forces, traditional metrics aren’t working – Analysts

As gold prices continue to hit record highs, experts at leading banks are updating their forecasts for the precious metal even as they try to determine where the price action is likely to head.

Francisco Blanch, Head of Commodities and Derivatives Research at Bank of America Securities, told Yahoo Finance that the gold market is caught in a daily tug-of-war between powerful cyclical and structural forces.

“We've seen tremendous gold buying on the back of central banks, and more recently there's been retail gold buying in China, but I think we have to distinguish the kind of temporary cyclical rate factors driving gold here from what's more structural,” Blanch said. “In the case of gold, I think there's a really big structural trend towards more gold purchases driven by the major geopolitical fracture that we have in the world today between the U.S. and Europe on one side, and Russia China on the other. It's really been central banks not trusting central banks that has been behind the buy-the-dip mentality in the gold market.”

Blanch said that this central bank-driven gold rally has made investors “maybe a little bit too excited,” and some of those longs are being liquidated following Wednesday’s higher-than-expected CPI report. “That's the story, inflation print hotter than expected, makes the Fed less likely to cut in June,” he said. “Why own gold? At this stage there are better alternatives for building higher returns. That's the battle that we are seeing every day.”

Blanch reiterated that Bank of America still expects three rate cuts in 2024, but gold prices could tumble if the Fed doesn’t deliver. “We are still calling for a rate cut in June, and two more in the second half of the year, so based on that, we think prices continue to go higher, but there is definitely a challenge for the gold market If the Fed doesn't cut rates this year, or as some people have claimed, if the Fed hikes rates.”

“I think it'll be pretty bad for the gold market and pretty bad for gold positioning.”

Blanch said shifting interest rate expectations are also impacting currencies, which are affecting gold prices in turn. “It's not just gold, it's also the fact that higher inflation in the U.S. leads to persistently higher interest rates, persistently higher, stronger dollar and therefore makes assets like gold less valuable,” he said. “There's a risk on that gold trade, and the risk is the Fed doesn't cut, or potentially hikes.”

He added that if things do get to the point where the Fed hikes rates further, he still expects central bank buying to prevent the gold price from collapsing. “I would expect central banks to come in and eventually put a floor on the market,” Blanch said. “Central banks are not going to be chasing the gold market higher, they're going to be buying on dips.”

HSBC Chief Commodities Analyst James Steel told Bloomberg Radio that the gold market's latest surge is being driven by geopolitical risks, as well as national and regional economic factors affecting the broader market.

“It's a default play,” Steel said. “In the case of China, specifically, the property market's been very weak, the equity markets have been very weak, and this narrows the universe that investors big and small are likely to look for. Gold is a great safe haven.”

Steel said that gold is also seeing interest in other countries, but the drivers are different. “Now we're seeing the same thing abroad, but the equity and property markets haven't fallen abroad,” he said. “In the case of Western markets, I think what we've seen is asset managers, portfolio managers and the like have recognized that equities are very high. They have no choice in many cases but to be in equity markets, but they have a choice how they hedge that exposure, and they've chosen gold.”

Asked how investors can properly value gold at these levels, and judge if and when it’s overvalued, Steel acknowledged that the traditional metrics are less useful than ever.

“I think that's a universal problem,” Steel said. “Cost of production won't help you at all because the market is well above the average, all-in sustaining costs of production, or any measure that you want to look at, with maybe except for one or two gold mines in the whole world.”

Steel said the traditional barometers that indicate when to buy or sell gold are also not working very well. “For example, we were looking for 150, 160 basis points [in Fed cuts]. When I say we, I mean Wall Street, in January,” he said. “That's contracted to below 75 basis points of cuts. That would normally have led you to think that gold would recalibrate lower between January and now, but the opposite has happened. Real rates are positive, that should be providing headwinds, and the dollar has been reasonably firm. None of those things seem to be making a huge impact.”

Steel emphasized that he believes the geopolitical elements are having a very strong effect on the gold market. “We've seen a lot of geopolitically-led safe-haven buying coming in, and there's academic studies to show that gold hedges well against geopolitical risk as well as it does against financial market risk.”

“Right now we are in a bit of a no-man's-land here, where the traditional issues would not provide you with the guidance that you would normally think,” he said. “Now, over time, physical demand outside of China is suffering. It was down last year in India. A ten-gram bar in India is now â¹71,000, double what it was just a few years ago. Jewelry demand is declining. Most people that want to buy coins have already done so. And I would suspect that if we get an equities correction, and I'm not saying that we will, that's well outside my pay grade, but that itself could bring an end to some of the safe-haven portfolio buying that's coming into gold.”

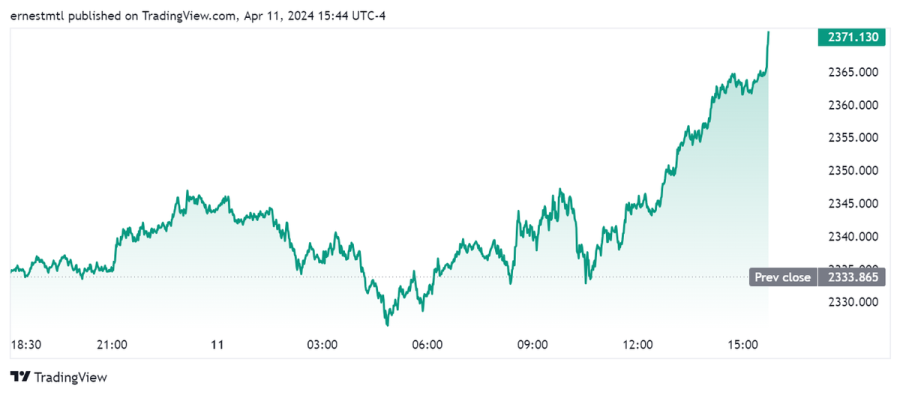

Gold prices are breaking out once again on Thursday afternoon, with spot gold setting a new all-time high of $2,371.13 per ounce at the time of writing.

Kitco Media

Ernest Hoffman

Tim Moseley