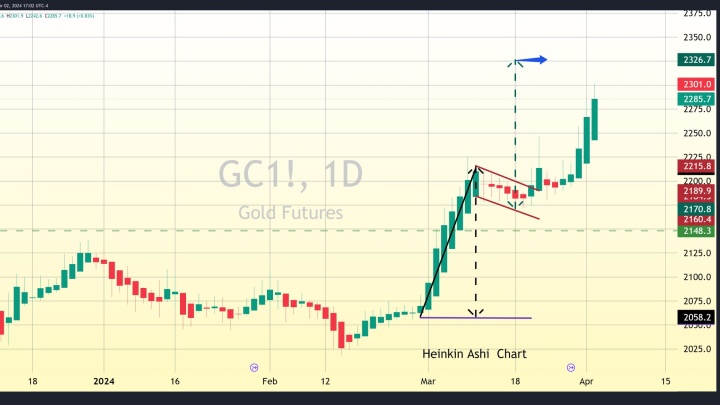

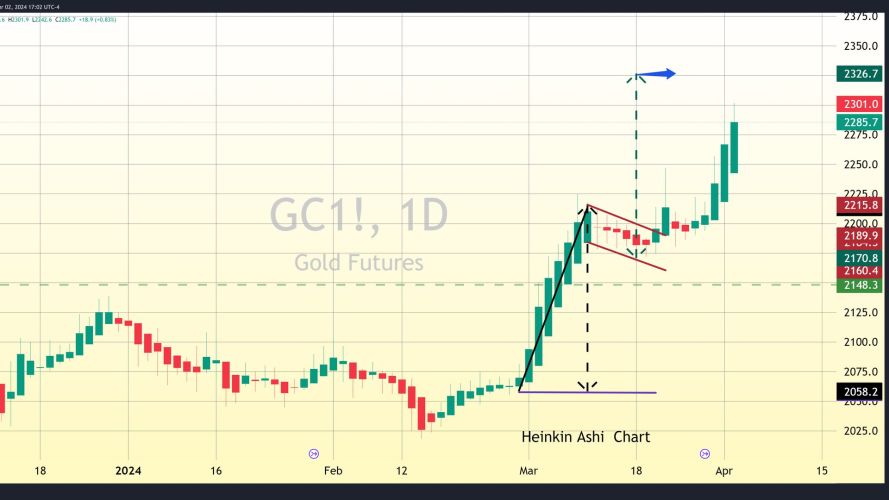

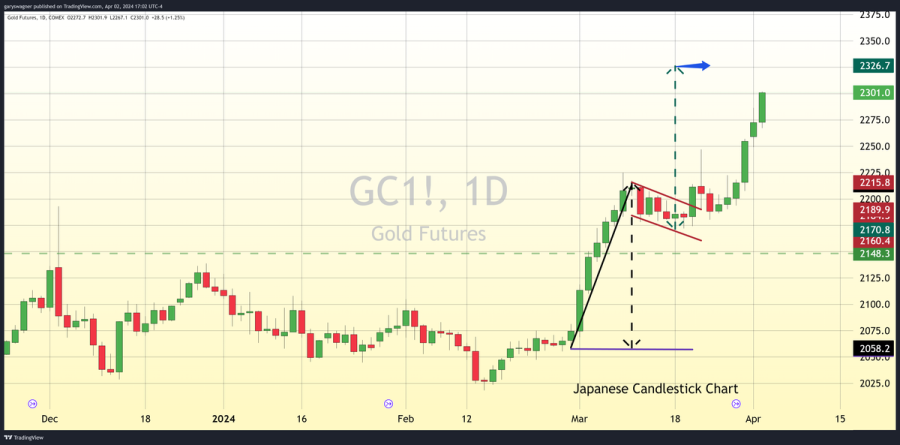

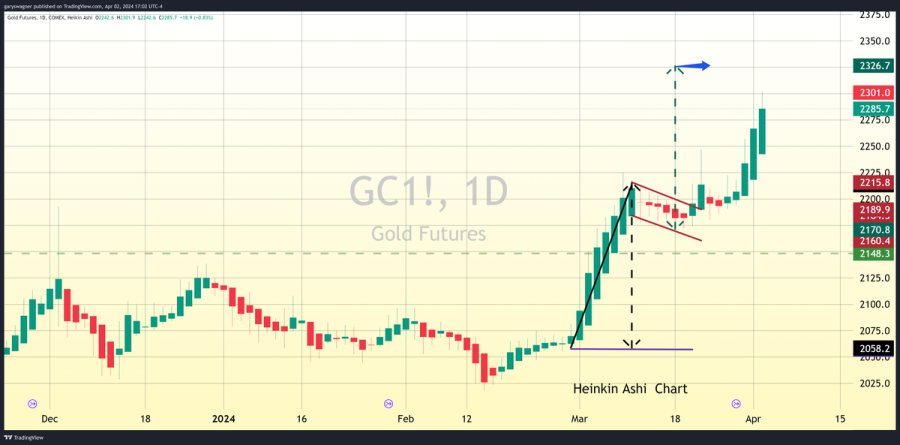

Multiple factors combined takes June gold futures to a new benchmark, $2300

As of 4:55 PM EDT the most active June contract of gold futures is fixed at $2300.60, up $28.100. This marks the sixth consecutive day of gains for the precious yellow metal, with the last four trading sessions culminating in new record closes.

During the past five days, gold managed to overcome the headwinds of four days of dollar strength, which typically dampens the appeal of the yellow metal. Also, gold was able to overcome rising yields in U.S. Treasuries, which also lessens the allure for gold.

The dollar's strength today can be attributed to a recent report revealing that U.S. manufacturing grew for the first time in 1 ½ years in March. Data from the U.S. showed that the country's factory orders rebounded more-than-anticipated, and the number of job openings slightly beat estimates in February, indicating the strength of the U.S. economy and narrowing the window for the Fed to start reducing interest rates.

Gold's recent gains also occurred as the CME's FedWatch tool lowered the probability of a rate cut in June from 60% to 58%. Last week the probability of a rate cut in June was at 70%, highlighting the shifting expectations surrounding the Fed's monetary policy stance.

Geopolitical tensions have also played a role in accelerating the demand for gold as a safe-haven asset. Growing conflicts in the Middle East, particularly an Israeli airstrike on Iran's embassy in Syria, have heightened concerns. Iran has vowed to retaliate against Israel for the attack on the Iranian embassy compound in Damascus, further elevating geopolitical uncertainty.

Supply constraints have also contributed to gold's recent surge. Central banks globally have been actively adding gold bullion to their reserves, diminishing available supply. Additionally, momentum hedge funds have been actively taking long positions in gold futures, further fueling the rally.

Moreover, rising oil prices have added to the demand for gold, as higher energy costs translate to heightened inflationary pressures down the road, making the precious metal an attractive hedge against inflation.

With a confluence of factors driving its ascent, gold's resilience and appeal have taken the most active June future’s contract above $2300 for the first time in history.

Wishing you as always good trading,

Kitco Media

Gary Wagner

Tim Moseley