ETF inflows skyrocket in July as North American funds join the party to drive global growth – World Gold Council

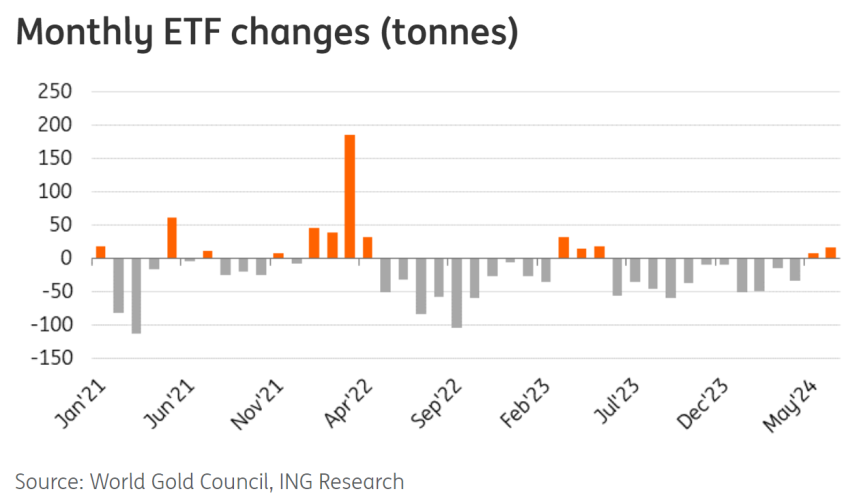

Global gold ETFs enjoyed their strongest month of inflows since April 2022 after North American funds finally joined their counterparts, according to data from the World Gold Council.

In their latest Gold ETF Flows report for July, analysts at the World Gold Council reported that global gold-backed exchange-traded funds (ETFs) saw their third consecutive month of inflows, adding $3.7 billion in bullion investment during the month. And while the numbers were very strong, the biggest surprise was the region that drove the growth.

“Notably, all regions reported positive flows this month with Western gold ETFs contributing the most,” the WGC wrote. “A combination of the July inflow and a 4% rise in the gold price pushed total global assets under management (AUM) 6% higher to US$246bn, a new month-end record. Collective holdings concluded July with a 48t increase, reaching 3,154t.”

.png)

“Successive inflows over recent months have narrowed the y-t-d loss in global gold ETFs to US$3bn,” they noted. “And while collective holdings have fallen by 72t (-2%) so far in 2024, their total AUM rose by 15%, supported by a 17% increase in the gold price.”

European and North American funds are still negative overall in 2024 despite the trend change in July, they said, while Asia has recorded sizable inflows this year.

In terms of the regional breakdown, North American funds recorded $2 billion in inflows, more than making up for the minor outflows seen in May and June.

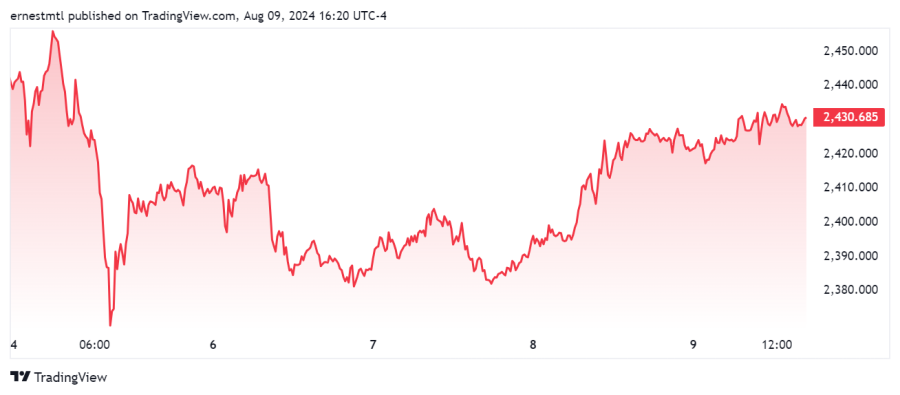

“July was unprecedented in the political front with the assassination attempt on Trump followed by Biden stepping down from the presidential race,” they noted. “Gold ETF saw inflows around both dates, pointing to increased safe-haven demand. Meanwhile, falling inflation, the cooling labour market and the US Fed Chair Powell’s note that a cut in September is ‘on the table’ during the recent meeting intensified investor expectation of easing soon. In turn, US Treasury yields fell and the dollar weakened, pushing the gold price to a record high during the month and spurring investor interest in gold ETFs. Furthermore, we believe equity market volatilities, especially during the second half of July, also supported gold ETF demand.”

North American outflows now total $2.9 billion year-to-date, and collective holdings have fallen by 52t, second only to Europe. “Nonetheless, driven by recent inflows and the notable gold price strength, the total AUM of North American funds has risen by 14% y-t-d,” the analysts said.

But the tide had already turned in Europe months ago. The region “has now recorded inflows over three successive months, attracting US$1.2bn in July, the strongest since March 2022,” the WGC noted, with the UK and Switzerland leading inflows.

“A common backdrop across the region in July has been declining government bond yields,” they said. “Although the European Central Bank left rates unchanged at their July meeting, Lagarde’s comment that the September decision is ‘wide open’ intensified investor expectation for another cut in the near future. Meanwhile, investors had expected the Bank of England to start its easing cycle on 1 August – and it lived up to the market consensus, cutting 25bps, the first time in four years. In addition, a commitment to address fiscal challenges from the new UK Chancellor, Rachel Reeves, helped restore some confidence in public finances and contributed to a lowering of UK gilt yields.”

“And as the opportunity cost of holding gold fell, investor interest in gold ETFs rose in the region – further boosted by a record-setting gold price,” they said.

The last three months of inflows have narrowed the European losses to $3.7 billion year-to-date, and cut the overall decline in holdings to 66 tonnes. “Similar to North America, a higher gold price, alongside recent positive demand, lifted the total AUM of the region’s funds to US$103bn, a 12% rise,” the analysts said.teaser image

Asian investors, meanwhile, bit the bullet of high prices for the yellow metal as they extended the region’s consecutive streak of inflows to 17 months with $438 million in net gains in July, with India leading inflows.

“Strong Indian demand was mainly aided by changes announced in the recent budget which effectively shortens the long term investment qualifying time period and lowered the associated tax rate which makes the investment landscape for gold ETFs more equitable and attractive,” the WGC wrote. “A strong gold price in the local currency also helped. Net inflows were also observed in China and Japan – likely driven by similar factors namely equity market weaknesses and strong local gold price performances in the month.”

Even with the relative slowdown in the pace of growth in July’s, Asia has still registered total inflows of $3.6 billion in 2024, “significantly outpacing all other markets,” with China and Japan the main drivers. “Supported by record-breaking inflows and a higher gold price, the total AUM of Asian funds reached US$15bn, the highest ever, while collective holdings increased by 47t,” the analysts said.

“In other regions, July marks a second consecutive month of mild inflows, mainly from South Africa where post-election political uncertainties may have helped,” the WGC said. “Australia also experienced positive flows, likely fuelled by a strong gold price performance in the depreciating local currency. So far in 2024 funds listed in other regions saw inflows of US$40mn, due mainly to South Africa.”

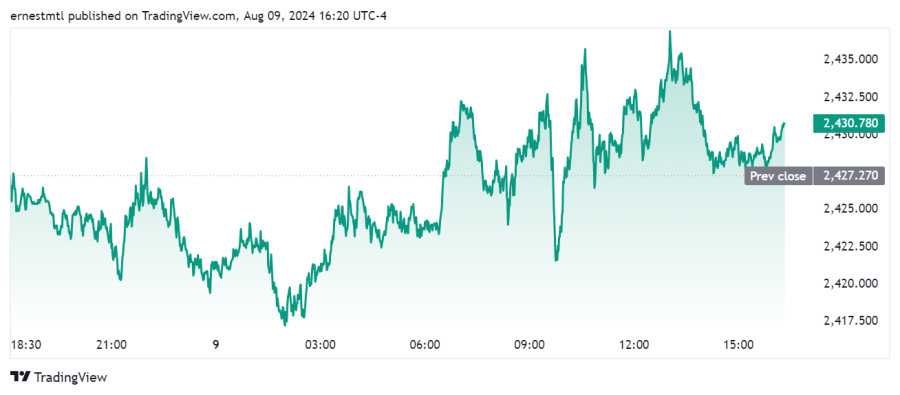

Trading volumes also rebounded across global markets, averaging $250 billion per day in July, an increase of 27% from June and well above the 2023 average of $163 billion per day.

“Similar to June, stronger LBMA volumes drove global over-the-counter (OTC) trading activities 16% higher to US$150bn/day, representing a 13% m/m rise in tonnage terms,” the analysts noted. “Trading volumes across all major exchanges rose in July, a staggering 51% increase m/m with COMEX leading the rise. Trading activities of global gold ETFs also rose, increasing by 9.3% m/m, mainly driven by North American funds.”

COMEX total net longs also saw a significant rise of 2% during the month, finishing July at 783 tonnes. “Continued strength in gold and falling yields amid intensifying expectations of lower interest rates ahead pushed money manager net longs – the major component of COMEX gold net longs – to 588t by the end of July,” the WGC said. “This represents a 2% m/m rise and the highest month-end level since February 2020.”

Kitco Media

Ernest Hoffman

Tim Moseley