Wall Street experts and Main Street investors see gold climbing higher next week as momentum builds

.jpeg)

Precious metals investors embarked on a now familiar roller coaster ride this week, but the ups and downs brought them back to nearly the same level, albeit an elevated one.

Spot gold opened the week trading around $2,505 per ounce, before dipping below the $2,500 level in the middle of the European trading session. North American investors found the yellow metal trading just below $2,490 per ounce at the open, and they promptly pushed it back above $2,500, where it traded throughout Monday, barring a few dips.

Gold prices hit their high-water mark for the week early Tuesday, in a sharp move up that began during the Asian trading session and continued throughout the day, with gold topping out above $2,530 per ounce 15 minutes after American markets began trading. The high was short-lived, however, as spot gold slid all the way back to $2,506 by noon Eastern.

The middle of the week was a period of consolidation that saw spot gold oscillate between $2,519 and $2,500, which was starting to look like solid support as the days wore on. But Thursday morning brought the release of worse-than-expected U.S. jobless claims, which drove gold from $2,503 at 8:30 a.m. down to the weekly low of $2,475 per ounce by 10:00 a.m. EDT.

From there, it was a slow and steady march higher over the final two days of the week, with spot gold double-topping back at $2,500 per ounce early Friday morning, before breaking decisively through resistance during Federal Reserve chair Jerome Powell’s highly anticipated address from Jackson Hole, which seemed to confirm that the central bank is prioritizing weakness in the employment market over lingering inflation.

After a double-top near $2,517 per ounce shortly after 11:00 a.m. EDT, gold settled into a narrower range on either side of $2,510 for the duration of Friday's trading session.

.png)

The latest Kitco News Weekly Gold Survey shows a solid majority of both industry experts and retail investors believe gold will rise above this week’s recent all-time highs.

“Gold set a record high on Tuesday near $2531.75 in the spot market and consolidated for the rest of the week,” said Marc Chandler, Managing Director at Bannockburn Global Forex. “The week’s low was set Thursday slightly below $2471. The dollar was mostly softer and interest rates lower. I expect the US dollar and rates to trade firmer over the next week or so, in the run-up to the US jobs report on September 6.”

“The yellow metal can make a new high, but the momentum indicators are getting stretched and my outlook for the dollar and rates suggests gold may have a consolidative phase,” Chandler added. “Initial support may be in the $2460-70 area.”

“Higher,” said Adam Button, head of currency strategy at Forexlive.com. “There is no sense in fighting the momentum.”

Darin Newsom, Senior Market Analyst at Barchart.com, sees gold prices trending lower during the days ahead. “I will stick with this direction for another week based on the idea Dec gold’s short-term trend (daily close-only chart) has turned down,” he said. “The downside target is near $2,493.”

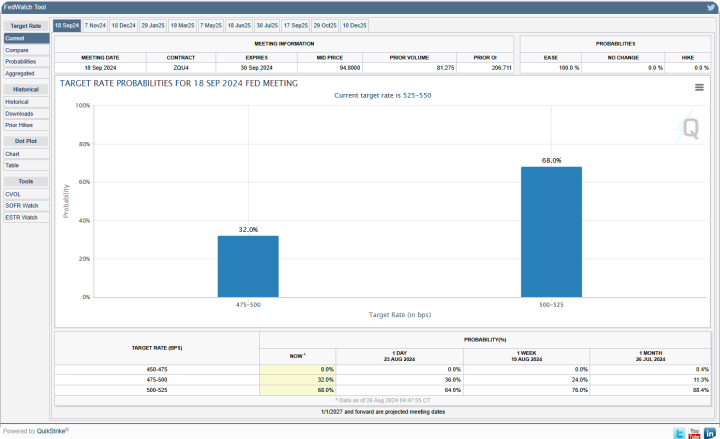

Kevin Grady, President of Phoenix Futures and Options, said the gold market is squarely focused on the Fed’s expected rate cuts, and with good reason.

“They’re talking about the rate cuts,” he said. “Now we're starting to see it's 55 percent that they're going to be able to do a 50-basis point cut instead of a quarter, but I think that the rates are going down. You've seen the central banks are buying, so I think that's the key right now, is the right people are buying it. You're getting a ripe, fresh environment for gold. I think new highs are ahead for gold.”

Grady said that gold’s performance even in a high-rate environment means that the precious metal will fly higher once rates begin to fall. “We've been waiting for that, and gold has been steady, holding up the whole time, even with all these Fed meetings where you're getting no rate cut,” he said.

“I think right now the time is prime for gold. It's like the perfect storm in a positive way for gold, so I think you're going to be seeing higher prices.”

Grady sees gold trading around $2,500 going into the September meeting and thinks that level could act as a floor once the first rate cut goes through, but the real support is somewhat lower.

“We've been hitting lower levels, there's been some levels that we've held down there, like $2460, that's the level for me,” he said. “I know a lot of people look at $2,500, but that's more of a psychological number. I think you look at that support number, what it held, and that's what I would be looking for.”

Grady also believes the massive 800,000-plus revision to the last 12 months’ jobs data has solidified the Fed’s resolve to lower interest rates. “I think it’s going to spur the rate cuts,” he said. “I think they should have cut at the last meeting. They should have at least done a quarter point as a signal for the market to get ready.”

“It's tough, anytime you're thinking about doing a 50-basis point cut right away,” he added. “To me, that shows, ‘Oh, we missed the window.’ I think you do it incrementally, that's the way to do it. But I do think that things are softening. You saw when the U. S. market's going down, a lot of these global markets are following suit. I think that it should be September.”

“I don't think they're going to do 50 basis points, but that revision, that would be the one thing to spark it.”

Grady thinks that the rate cuts are not the end of the story, however, because the overall economy is still very inflationary, and the cuts could increase those pressures.

“They're going to be cutting rates into an environment that's extremely inflationary and still hasn't come off,” he said. “It's going to be really interesting.”

This week, 12 analysts participated in the Kitco News Gold Survey, with a solid majority of Wall Street seeing potential gains above this week’s fresh all-time highs. Seven experts, or 58%, expect to see gold prices rise during the week ahead, while two analysts, or 17%, believe gold will trade lower next week. The remaining three experts, representing 25% of the total, predicted a sideways chop for the precious metal.

Meanwhile, 225 votes were cast in Kitco’s online poll, with Main Street investors more bullish on balance than their expert counterparts. 146 retail traders, or 65%, looked for gold prices to rise next week. Another 41, or 18%, expected the yellow metal to trade lower, while 38 respondents, representing the remaining 17%, saw prices consolidating during the week ahead.

.png)

Market participants will be focused on key inflation data next week, with July’s U.S. Personal Consumption Expenditures (PCE) Index on Friday the clear highlight. Markets will also receive U.S. Durable Goods Orders for July on Monday and August Consumer Confidence on Tuesday, with weekly jobless claims and U.S. Preliminary Q2 GDP released on Thursday morning.

Traders will also pay attention to comments from the Fed’s Christopher Waller early Wednesday morning, and Raphael Bostic on Thursday afternoon.

James Stanley, senior market strategist at Forex.com, thinks gold prices will trend lower next week. “I think we’ll see some profit taking and a pullback to test below $2500, but I’m not expecting any bearish sequences to be long-lasting at this point,” he said. “More of a pullback than a reversal.”

John Weyer, Director of the Commercial Hedge Division at Walsh Trading, said he was surprised at how many market participants expected Powell’s Jackson Hole speech to deliver new information.

“I've been chuckling to myself how many people are looking for action today, as if the Fed's going to step out of their norm of clear forecasting and tipping the hat on what they want to do and when they're going to do it,” he said. “I think today's comments are basically, he's not rocking the boat for anything they've said previously, and I feel like they're on a schedule to take some action in September.”

“One thing they've been good at in recent vintage is they tell you what they're going to do, and they stick to it, they don't throw you any surprises,” he added. “And I think they're continuing down that path.”

Weyer believes that this week's massive revision to the last 12 months of jobs data gives the Fed cover to cut deeper than 25 basis points. “It got us to the idea that their first action could be 50 basis points,” he said. “I think that was set up a few weeks back as well. And I think that change, from previous signals and his comments at the last Fed meeting, hinted that perhaps they might be open to, based on data, as they always point to, a more aggressive action at the beginning. They've been saying for as long as these concerns started, ‘we're going to point to the data, we're going to rely on the data, we're going to go off data. They didn't reverse or throw something new, so I think they've already given the hint.”

“I'm going 50 basis points,” Weyer said. “There are still some people who are skeptical, they think that's too much for first action, but I think they realize the new data tells them they have to take action. Other people want to say they're doing that because they waited too long. Maybe they did. We don't know until after. But it certainly gives them license to perhaps go more aggressive at the front end.”

In terms of market levels, Weyer said that while a round number like $2,500 gets a lot of attention, it may be a little too high to act as support.

“When you get to those large numbers, that becomes a psychological level as well,” he said. “You have to consider all the participants now who are new, or pay attention to these things, as opposed to the everyday participants that have to go hedge the markets. I think $2,500 is a good area. We've got some stuff here, $2,450 as well, but I think the psychological and the technical are going to hold there.”

“These are areas, not exact numbers,” he added. “If over the course of a few weeks, you get to $2,480 on a chart, it's not that far off.”

"What will be interesting to see is, if they take action and rates go lower, what gold continues to do,” Weyer said. “It's become a safe haven play for sure, but what tells me that maybe it might slow down is silver's making a good move today but in a lot of the recent strong moves to the upside with gold, there's been a not as big a move for silver, which is more of an industrial use. That tells me there's a lot of noise around gold as well, that may not have the support to continue to move higher."

"Silver slowed down a bit because it's a practical metal, it has much more uses than gold. The attraction of gold is the same as it was a thousand years ago. You get many people in times like these, concerns about rates, concerns about the economy, concern about inflation, geopolitical concerns. I don't know that they sustain some of those moves to the upside,” he said. “But somewhere between $2,500 and $2,450, should be some support in there.”

Michael Moor, Founder of Moor Analytics, expects the yellow metal is likely in for a period of consolidation during the week ahead. “On a higher timeframe: The solid trade above 21475-84 projects this upward $151 minimum, $954 (+) maximum. We have attained $415.4. This is ON HOLD,” he said. “On a lower timeframe basis: The trade above 23276 (-2 tics per/hour) warned of decent strength—we have attained $236.2. This is ON HOLD.”

“The solid trade back below 25403 warns of solid pressure, likely for days,” Moor added. “I would CAUTION we came shy of higher timeframe exhaustion at 25752 with a 25704 high and rolled over into a lower timeframe bearish correction/trend against the move up from 24038, but what could possibly be a higher timeframe correction against the move up from 19339—and if so the minimum target would be 23950. Decent trade below 25173 (+3.3 tics per/hour) will project this downward; but if we break below here decently and back above decently, look for decent strength. Solid trade back above 25405-07 will once again warn of solid strength.”

And Kitco Senior Analyst Jim Wyckoff sees both the technical picture and fundamental factors favoring price gains for gold next week. “Higher as charts, fundamentals remain overall bullish,” he said.

At the time of writing, spot gold last traded at $2,509.97 per ounce for a gain of 1.02% on the day but a nearly flat reading of 0.13% on the week.

.png)

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

Tim Moseley

.png)

.jpeg)

.png)

.png)

.jpeg)

.png)

.png)

.png)

.gif)