El Salvador’s Bitcoin Investment Has Netted $85 Million In Profits Thanks To BTC Price Record Highs

By Brenda Ngari – March 12, 2024

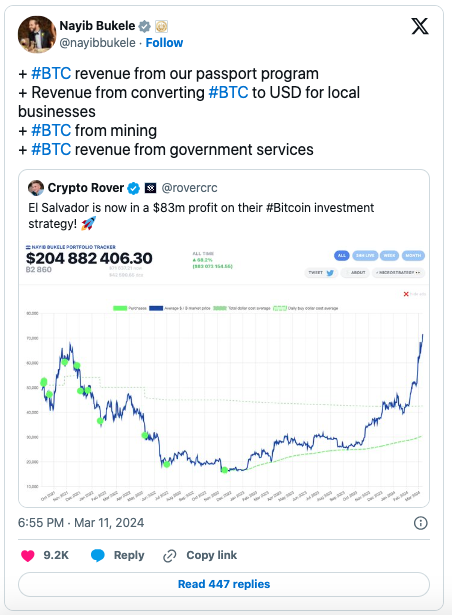

Salvadoran President Nayib Bukele’s decision to purchase Bitcoin (BTC), the world’s oldest and largest cryptocurrency, has certainly paid off. BTC’s latest rally to new all-time highs has thrust the Central American nation’s BTC portfolio into the black by $85 million, data indicates.

BTC Profits Hit $85 Million

Bitcoin was first adopted as legal tender in El Salvador in 2021, and since then, the country’s stockpile has gone from crypto winter rags to record riches. Since President Nayib Bukele announced that his government would start buying 1 BTC per day, it has accumulated roughly 2,861 BTC — according to the NayibTracker website — acquired at an average cost of $42,600. At Bitcoin’s new all-time high of $72,710 on March 11, this was worth over $207 million. He spent over $122 million on the cryptocurrency, meaning he’s up over $85 million.

El Salvador’s embrace of the benchmark cryptocurrency has proved contentious both at home and abroad, with the passing of the historic “Bitcoin Law” welcomed by protests, while everyone from university professors to the World Bank and U.S. lawmakers slagging off Bukele’s “careless gamble.”

However, the pro-Bitcoin president, who in February was reelected in a landslide presidential election victory — has been unfazed by the criticism, forging ahead with the tiny Latin American nation’s plans for a Bitcoin City — a tax-free city powered by a volcano and financed by BTC-backed bonds.

Bukele indicated in a March 12 post that El Salvador is accruing even more BTC in the form of revenue from other avenues. This entails revenue from the “freedom visa” passport program, which converts Bitcoin to United States dollars for local businesses, BTC mining, and revenue from government services.

El Salvador announced the visa program in December, offering foreigners a passport and residency if they invest $1 million in Bitcoin or Tether’s USDT. Months before that, in October, the nation launched its first local BTC mining pool in collaboration with Volcano Energy and Luxor Technology.

Venture capitalist Tim Draper recently suggested that El Salvador will be able to fully pay off its IMF debt if Bitcoin hits $100,000 and thereafter become financially independent.

DISCLAIMER: None Of The Information You Read On ZyCrypto Should Be Regarded As Investment Advice. Cryptocurrencies Are Highly Volatile, Conduct Your Own Research Before Making Any Investment Decisions.

The original article written by Brenda Ngari and posted on ZyCrypto.com.

Article reposted on Markethive by Jeffrey Sloe

** Loans, secure funding for business projects in the USA and around the world. Learn more about USA & International Financing at Commercial Funding International. **

Tim Moseley