Global Risks Report 2023: What does the WEF have in store for us now?

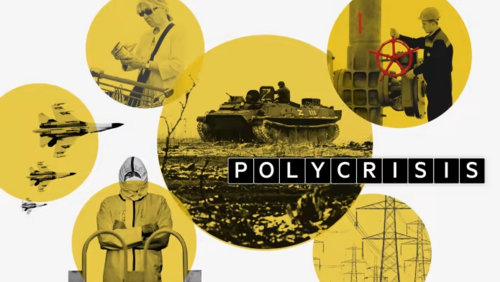

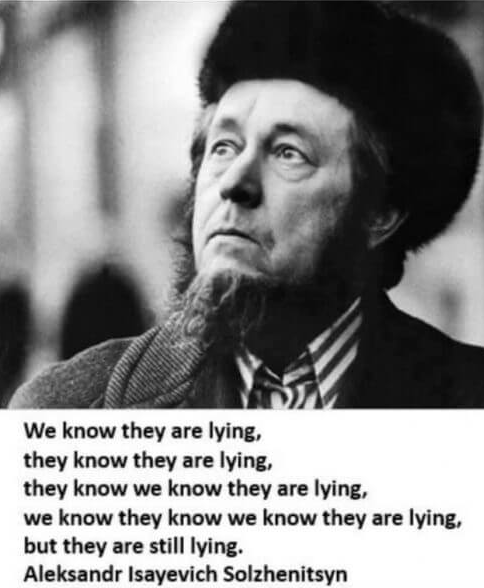

The World Economic Forum (WEF) has made headlines, particularly over the last few years, and more people have become aware of who and what they are. The WEF recently published a report detailing the risks the world will experience over the next two to ten years, according to so-called experts in various fields. The WEF Global Risks Report 2023 is the 18th edition and covers all aspects of worldly affairs, which they’ve named a polycrisis.

Following is a summary of the WEF’s 98-page document on the upcoming polycrisis. Most, if not all, of what I would argue are arrogant, contradictory, and delusional assumptions. They’ve been known to call them predictions, and some would label them as promises.

Image source: WEF Global Risks Report 2023

Preface: The Blame Game

The report begins with a brief preface by WEF managing director Saadia Zahidi. She discusses how carbon emissions have increased because pandemic restrictions have been dropped and blame the energy crisis, the food crisis, and soaring inflation on the war in Ukraine.

The fact is the energy crisis began long before the war in Ukraine and is the consequence of the ESG ideology that the WEF invented. Although the war has contributed over the last year, the ESG-induced energy crisis that has been in play for years is causing inflation.

Saadia notes, "The resulting shift in monetary policy marks the end of an economic era defined by easy access to cheap debt and will have vast ramifications for governments, companies, and individuals, widening inequality within and between countries.” She explains that the world is quickly deglobalizing and that only a few countries can be truly independent.

Regarding the so-called polycrisis, Saadia says this will be caused primarily by “shortages in natural resources, such as food, water and metals, and minerals.” She concludes by saying that this year's edition of the global risks report is a call to action to prevent this polycrisis.

Overview Of Methodology

The second part of the report details its methodology. The WEF got one part of the information for the account from 1,200 of its so-called experts from all areas of the economy. The report also specifies that the WEF got the other part of the information from the WEF’s executive opinion survey, which includes over 12,000 business leaders in 121 countries.

The report itself was written by 40 WEF members and 50 other influential people. The authors then define the term ‘Global Risk’ as “The possibility of the occurrence of an event or condition which, if it occurs, would negatively impact a significant proportion of global GDP, population, or natural resources.”

Executive Summary

In the third part of the report, the authors say that the new normal of the pandemic was quickly disrupted by another crisis: the war in Ukraine. What's interesting is that the authors talk about the pandemic as if it were over. However, according to the World Health Organization (WHO), we're still technically in a pandemic. The decision for this public health emergency was recently renewed at a WHO meeting on Friday, January 27, 2023.

The authors then list all the issues the world is facing today, including “unsustainable levels of debt and a new era of low growth, low global investment, and deglobalization, a decline in human development after decades of progress,” and every other disastrous thing, you can think of.

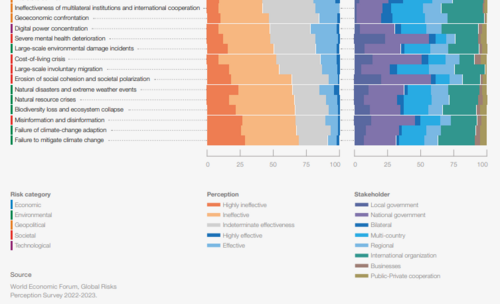

They provide the infographic below, which shows the issues the WEF experts are concerned with, ranked by severity. It illustrates that the cost of living crisis, natural disasters, and economic war is at the top of the list for the two-year period, while environmental-related issues are at the top of the list for the ten-year period.

The authors reveal that the polycrisis caused by the shortage of resources will simultaneously hit its peak in 2030, which is aligned with the deadline that the WEF and its affiliates have set for total world domination. What better way to do this than through successive manufactured crises?

Image source: WEF Global Risks Report 2023

The authors then warned that central banks worldwide would likely be fighting inflationary forces for the next two years. The resulting monetary policy, that is, high-interest rates, will do the most damage to developing countries, risking the collapse of these countries and mass migration.

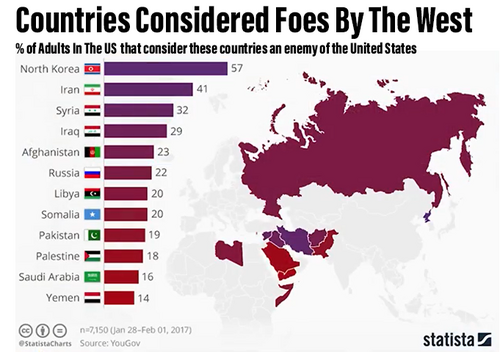

While the wars we’re going to see will be primarily economic, the authors seem to imply that China could soon invade Taiwan. To lessen the likelihood ground level combat in wars, the authors call for global controls to be imposed on the production and movement of weapons. They forgot that weapons would inevitably be easy for anyone to manufacture using 3D printers.

Additionally, the authors implicitly confirm that the technologies the WEF and its affiliates are developing will be designed to control the population. They claim that any country that does not have access to these technologies will fall victim to misinformation, the ultimate elite buzzword.

The authors also predict that there will be “attacks against agriculture and water, financial systems, public security, transport, energy, and domestic, space and undersea communication infrastructure.”

Image source: World Economic Forum

Notably, the WEF has recently been discussing these targeted cyber attacks a lot. Did you know cyber-attacks are a great way to justify online digital IDs? The authors argue that a failure to address the climate crisis means that crises such as the upcoming shortage of natural resources will be much worse. The authors fail to mention that government agencies have had the power to modify the weather for decades.

Cost Of Living Crisis

Regarding the cost of living crisis, the authors note, “Associated, social, unrest and political instability will not be contained to emerging markets as economic pressures continue to hollow out the middle-income bracket.”

In other words, the only two economic categories will be rich and poor. The ray of hope is that four in five WEF experts believe most of the damage will be done over the next two years. Half of them think these issues will be resolved by the decade's end. This may be because they brazenly believe the WEF and its cohorts will achieve total control.

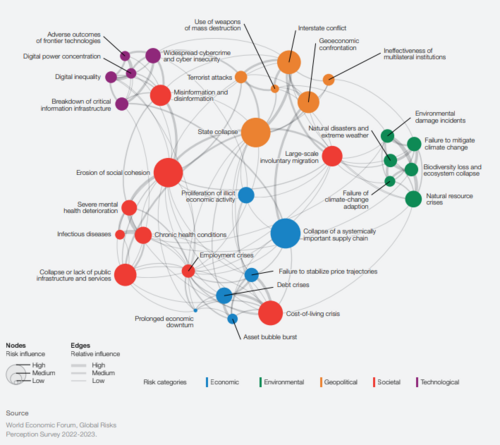

The impressive infographic below shows you how all these different crises will be connected. According to the WEF, the most critical emergencies will be the collapse of supply chains, erosion of social cohesion, and state collapse. It sounds like they know they're losing control.

Image source: WEF Global Risks Report 2023

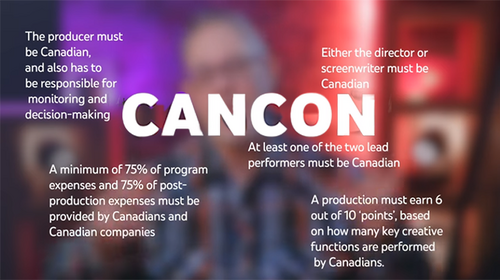

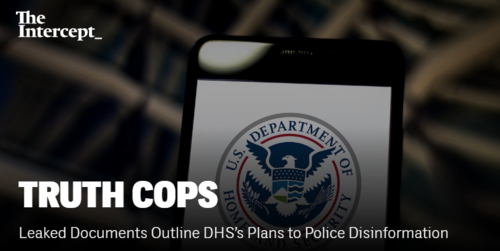

This ties into another infographic, which reveals that the participants in the WEF’s report believe that the powers that be are unprepared to address misinformation and disinformation. They recommend that governments act now. It looks like that’s exactly what they’re doing, which this article discusses.

Image source: WEF Global Risks Report 2023

Today's Crisis

The fourth part of the report is aptly titled “Today's Crisis,” with the WEF experts noting that the energy crisis, cost of living crisis, and rising inflation are the most important. One could argue that’s because these crises destroy people's trust in the elites. Funnily enough, the pandemic is noted as one of the least critical crises.

The authors refer to these crises as “older risks that were faced by previous generations.” However, they cautioned that these old crises are intertwined with new risks, such as high levels of debt, significant technological innovation, and an increasing skepticism of WEF-like institutions.

The report then breaks down some of today's crises in more detail. For the cost of living, they caution that energy prices will likely remain 50% higher than last year and say that China's reopening could lead to a surge in energy-driven inflation.

This will cause central banks to keep interest rates higher for longer.

They also claimed the cost of living crisis had provoked mass protests in 92 countries. 92?!; this is arguably a claim that is a somewhat exaggerated and distorted statistic. It underlines that the people in their apparent power are more desperate than ever to keep the narrative under control.

The authors explain that the international monetary fund (IMF) expects global inflation to drop from 9% in 2022 to 6.4% in 2023 and a further decline to 4.1% in 2024. They note that this slowdown in inflation will be felt the most in developed countries but caution that unemployment could keep it high.

They also caution that keeping interest rates higher for longer in developed countries could cause issues in developing countries, notably for their governments. In short, money is moving out of emerging market government bonds, risking a spike in interest rates that could cause defaults.

The authors then dare to claim that the geoeconomic dynamic caused Sri Lanka to collapse. In reality, Sri Lanka collapsed because it was trying to implement the WEF’s ESG policies on a national scale. The result was effectively a shortage of everything.

Image source: Twitter

The authors also note the Netherlands as the country most concerned about commitment to arbitrary and ever-changing climate goals. The Dutch government recently announced it would buy up and close down 3,000 family farms. The government claims this is because of the climate crisis, but many argue it has more to do with the Tri-State City that the Netherlands is building in partnership with the United Nations.

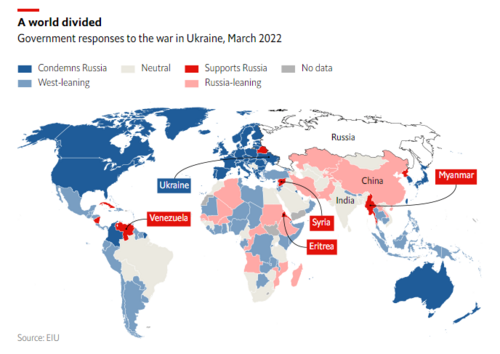

As for the geoeconomic warfare we're witnessing, the report states that the unprecedented sanctions against Russia sent a clear message to any country that opposes Western interests. ‘Western governments will seize your assets.’ It appears that this hostility is even occurring between allies; as the authors point out that the US president’s ironically titled Inflation Reduction Act incentivizes some EU companies to relocate to the US.

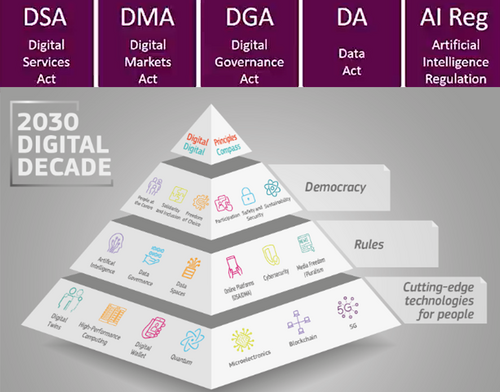

The Digital Markets Act was the EU's response to this blatant overreach. The authors caution that this situation will “likely continue to weaken existing alliances as nations turn inwards with enhanced state intervention perceived to drive a race to the bottom.” They even warn that global organizations such as the WHO will be weaponized for geo-political purposes.

Meanwhile, the authors say there's been a “divergence between what is scientifically necessary and what is politically expedient.” They go as far as criticizing Europe for turning to fossil fuels when it faced imminent energy shortages but also say that intermittent energy sources will not be sufficient.

When it comes to the societal polarization we're seeing, the authors assert that it lies at the core of all the other crises we're currently experiencing and could experience. Not surprisingly, they blame the free sharing of information, stating, “This is further amplified by social media, which increases polarization and distrust in institutions alongside political engagement.”

The WEF believes this free sharing of information is just misinformation and disinformation. They also acknowledge that “Regulatory constraints and educational efforts will likely fail to keep pace, and its impact will expand with the more widespread usage of automation and machine learning technologies from bots that imitate human written text to deep fakes of politicians.”

Tomorrow’s Catastrophes

If today's crises aren't terrifying enough for the WEF to control the population, the fifth part of the report talks about “tomorrow's catastrophes,” which might pay off if the WEF gets its way. Remembering that the top catastrophes have to do with the weather, which governments can, in fact, influence.

The authors group these long-term catastrophes into five categories: Natural ecosystems, Human health, Human security, Digital rights, and Economic stability. They stress that these categories are incomplete and can be used as templates for preparing for other upcoming crises.

1: Natural Ecosystems: past the point of no return

For natural ecosystems, the authors state that humans have disturbed the natural balance of nature, which is a bit funny considering that humans are a part of nature too. Some aspects of human life have gone to extremes, and this is doing damage to the environment.

According to them, the only solution is to control what the population consumes and where individuals can go. But of course, these restrictions won’t apply to them; they will continue to live the comfortable lives that nature intended for all of us, not just the elite few.

If that wasn't frustrating enough, consider the following, “land use change remains the most prolific threat to nature, according to many experts. Agriculture and animal farming alone take up more than 35% of Earth's terrestrial surface and are the biggest direct drivers of wildlife decline globally.”

Moreover, “The ongoing crisis in the affordability and availability of food supplies positions efforts to conserve and restore terrestrial biodiversity at odds with domestic food security.” Now, this is patently false because more farm animals could, in fact, potentially be part of the solution to climate change. I urge you to watch this video in its entirety. It proves these climate change extremists are dangerously messing with nature.

What's insane is that the authors suggest forgiving the debt owed by developing countries in exchange for their land so that it can be conserved. They admit that this would create serious food security challenges in these countries but don't seem to care all that much about this side effect.

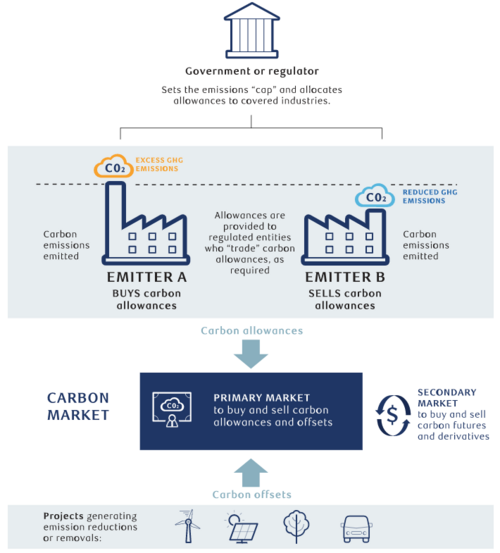

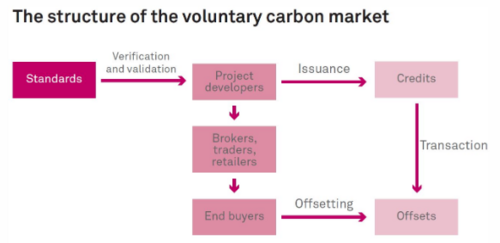

For what it's worth, the authors acknowledge that mining the minerals required to make things like electric vehicles and massive batteries for intermittent energy sources is hugely damaging to the environment and could disrupt ecosystems. It's a shame that they also seem to shrug off this side effect. The authors also discuss the issuance of carbon credits, which I discussed in this article.

2: Human Health: Perma-pandemics

Now for human health, the authors pitch the possibility of permanent pandemics, which I'm sure the WEF would love to see. Fun fact; research has shown that pandemics tend to occur every time there's a solar minimum when the sun is shining the least because it lowers vitamin D levels globally. Coincidently, the last solar minimum was around 2020. Could the WEF have known that?

.png)

Image source: Universe Magazine

Anyway, conspiracy theories aside, the authors can't help but insist that much of the human health issues we're going to see will be related to climate change. And, of course, they claim that all these issues will ultimately be due to disinformation and misinformation, causing distrust in evidently untrustworthy authorities.

3: Human Security: new weapons, new conflicts

In the case of human security, the report highlights concerns that the WEF experts have about internal conflicts. The authors also caution that the recent resurgence in militarization could set the stage for international disputes. They cover what weapons governments are constructing, such as anti-satellite and hypersonic weapons, directed energy weapons, and quantum computers.

They explain that Directed Energy Weapons are expected to make significant progress over the next decade, with the potential to disable satellites, electronics, communications, and positioning systems. Quantum computing may be harnessed and deployed to target vulnerabilities in sophisticated military technologies, ranging from disinformation campaigns to hacking hardware in nuclear defense systems.

The authors abstained from suggesting that hostile countries actively use weather modification weapons against each other. However, they did predict a rise in so-called rogue actors that eventually will get their hands on these advanced weapons, be they, individuals or organized groups.

4: Digital Rights: privacy in peril

Regarding digital rights, the authors point to the ever-increasing erosion of privacy as the primary issue. Ironically, the WEF doesn't want the average person to have privacy. Instead, they want to make sure their constituents have privacy while they make massive profits from our data.

The authors confirmed that “Individuals will be targeted and monitored by the public and private sector to an unprecedented degree, often without adequate anonymity or consent.” Most of the people who run these institutions in the public and private sectors are part of the WEF.

If that wasn't bad enough, the report says, “This pattern will only be enhanced by the metaverse, which could collect and track even more sensitive data, including facial expressions, gait, vital signs, brain wave patterns, and vocal inflections.” According to the WEF research, the poor will love the metaverse.

Additionally, it states, "Research suggests that 99.98% of US residents could be correctly re-identified in any data set, including those that are heavily sampled and anonymized.” In other words, these systems are so advanced that they can identify you, even if the information isn't directly linked to your identity.

As far as the authors are concerned, this is fine because “The right to privacy is not absolute. It is traded off against government surveillance and preventative policing for the purposes of National Security.” To be fair, they admit that this justification can, and often does, go too far.

5: Economic Stability: global debt distress

In the matter of economic stability, the authors emphasize the debt crisis that many countries are facing due to rising interest rates. What's funny is that the authors seem to be hoping for a recession because it will cause central banks to lower interest rates, reducing the debt default risk. They point to the UK's Gilt Market as an example of what could happen elsewhere if interest rates don't come down soon.

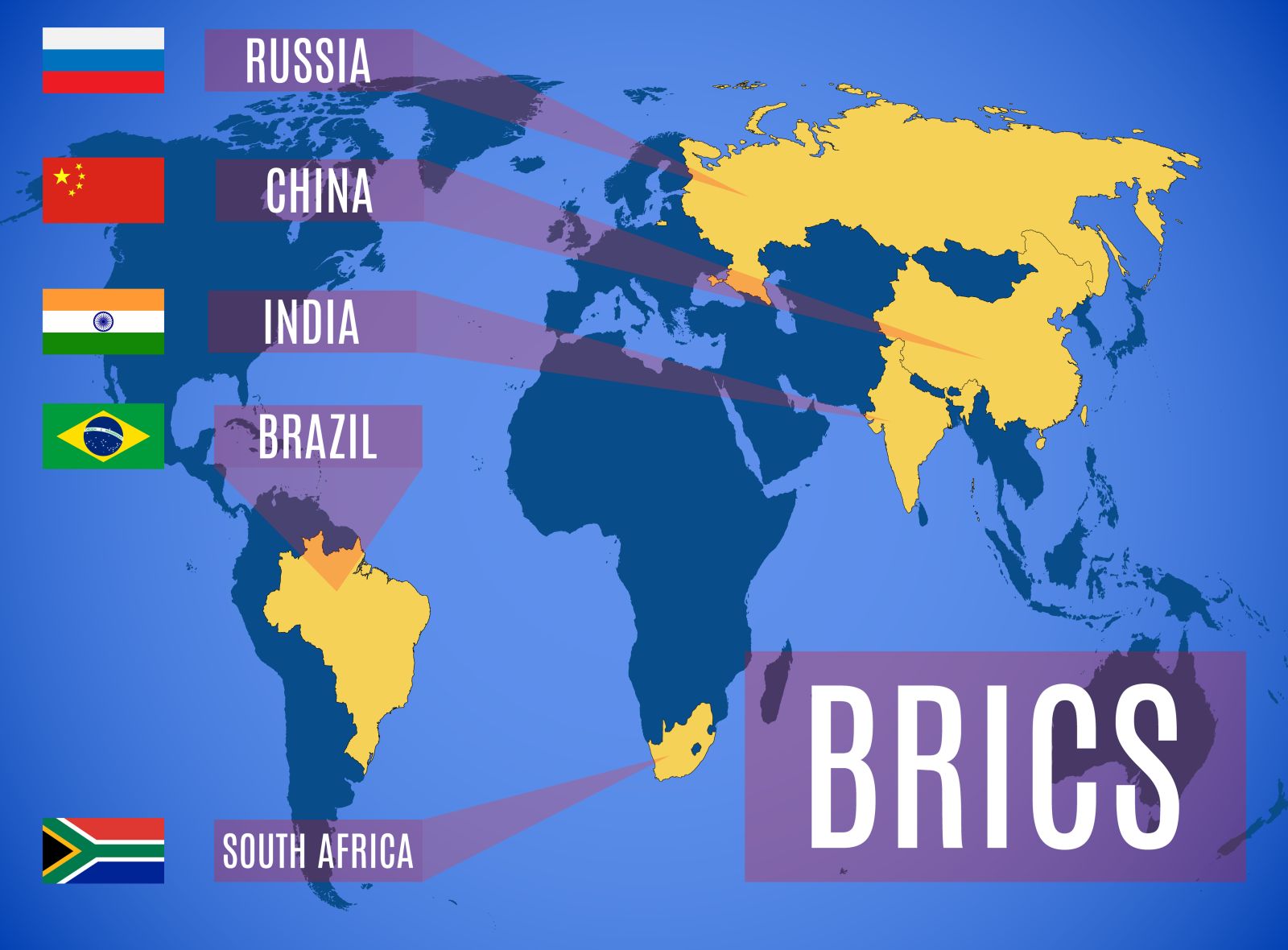

The authors reveal that China has become the world's largest creditor. In other words, China owns more of everyone's debt than anyone else. This is primarily due to China's Belt and Road initiative, which has given infrastructure loans to developing countries.

The authors caution that the credit crunch currently experienced by many countries means they'll be less able to spend money on building public infrastructure. This will further contribute to the world's other issues, hence why the authors are so obsessed with the term polycrisis.

Image source: Financial Times

Possible Outcomes For The Polycrisis

The authors then proceed to provide a clear definition of ‘polycrisis.’ “A cluster of related, global risks with compounding effects, such that the overall impact exceeds the sum of each part.”

It’s laughable that the authors admit that the polycrisis, which will again be caused primarily by a shortage of natural resources, is due mainly to the United Nations’ sustainable development goals (SDGs), which member countries of the UN are expected to achieve by 2030.

The report states the possible outcomes of this polycrisis defined in four categories. They are resource collaboration, resource constraints, resource competition, and resource control. The timeline for these possible outcomes is, of course, 2030.

The outcome of resource collaboration sounds like what's already happening. Countries cooperate, but the actual shortage of natural resources causes inflation to continue, leading to many of the same issues the authors have discussed.

Resource constraints are the same outcome but worse. The authors state, “In the absence of intervention, the water and mineral shortages experienced in the resource collaboration scenario act as a multiplier to broader risks.”

As for resource competition, the outcome sounds like what many analysts have predicted. Countries decide to reshore their supply chains in an attempt to become self-sufficient. The effect of resource control is self-explanatory. Nations fight each other for resources to become self-sufficient.

Ironically, the authors admit that the urgency of protecting the environment conflicts with strip-mining the planet for materials to make EVs and batteries. What's sad is that there's almost no mention of nuclear energy anywhere in this report; it's only mentioned in passing, not as a valid topic.

Besides precious metals and minerals, the authors are also concerned about water. They fail to acknowledge that most of the natural resource shortages they claim would occur could easily be solved by not relying on intermittent energy sources like wind and solar. Somehow, this isn't an option. Is it because most solar panels, wind turbines, and batteries are made in China?

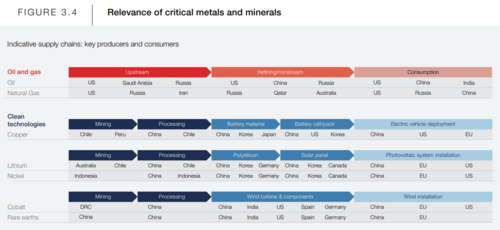

The infographic below illustrates that China plays a role at every step of the green energy roll-out.

Image source: WEF Global Risks Report 2023

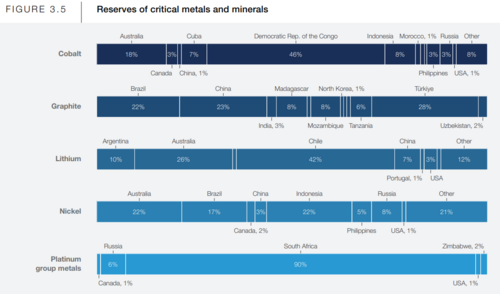

Below is another infographic that shows China doesn't have all the minerals the WEF needs to create its centralized smart grids and cities. Consider that countries could create nuclear power sources without relying on China, but then, the WEF wouldn't have centralized control of all the world's energy.

To clarify, countries like the DRC, Turkey, Chili, Australia, and South Africa, hold all the aces. The authors caution that there will be an intense power struggle for the resources in these regions. Nuclear is much easier, but according to the report, it's not an option, despite the recent breakthrough with nuclear fusion.

Image source: WEF Global Risks Report 2023

The Conclusion Of The Report

The authors repeat that we're entering a “low growth, low investment, and low cooperation era.” They recommend that the leaders at the WEF do four things to prepare for the upcoming polycrisis.

The first is to improve risk identification. The authors imply that the people in power should try to crush dissent when identifying future risks. They also call for establishing global organizations to keep track of future risks and tell countries how to address them.

The second is to rethink future risks. By this, the authors mean that the people in power should try and minimize the coverage of real-time risks that pertain to the average person. Instead, they should try and push people to become obsessed with future risks that have yet to occur, like climate catastrophes.

The third is to invest in preparedness. The authors reveal that the United States, the United Kingdom, and others are preparing to pass laws that will mandate public and private institutions to prepare for any kind of crisis that could occur over the next 30 Years.

The fourth is cooperating with other powerful individuals and institutions in the public and private sectors. The authors complain that international cooperation is deteriorating and urge countries not to become self-sufficient. Instead, they should become reliant on each other.

How Do We Prepare?

What do we do to prepare for the impending so-called polycrisis? The answer is to do the opposite of whatever the WEF wants. As mentioned above, the shortages in natural resources at the core of this polycrisis are rooted in the WEF’s ESG obsessions, per the author's admissions. If you read this article about how to survive the great reset, you'll know that ESG is the way that the private sector is driving the United Nations' SDGs.

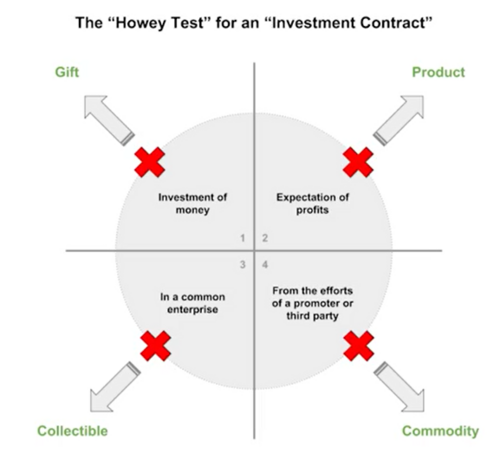

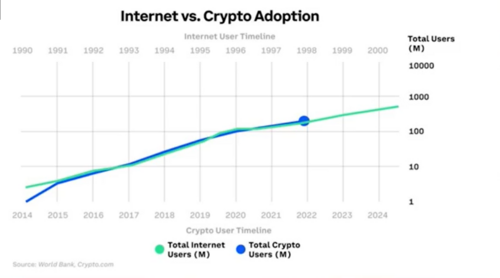

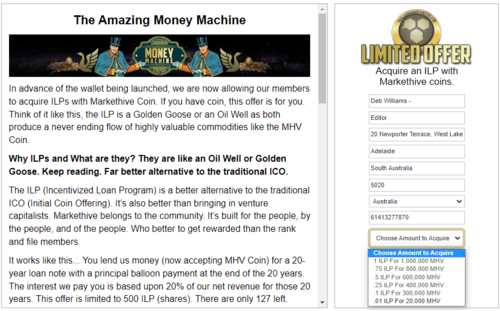

There's no denying that some genuine global issues need to be addressed. Some of the concerns that the WEFs correspondents have are very real. The problem is that they want to centralize control of the entire system to ensure it doesn't collapse, but that's not the solution. The solution is to decentralize everything.

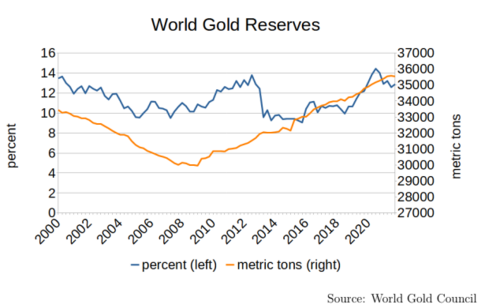

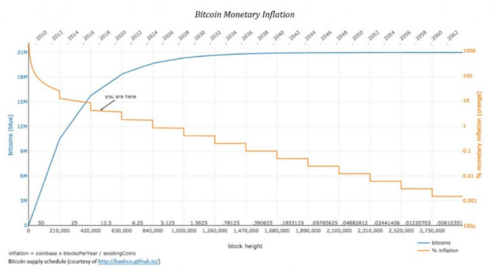

We can start by decentralizing money with cryptocurrency. This cryptocurrency should be hard money like gold to incentivize saving instead of spending, which will eliminate overconsumption. Then we can decentralize energy with nuclear power and accelerate the development of fusion power.

After that, we must decentralize information. Everything should be as open source as possible, and it should be possible to get information about the same issue or event from multiple sources—no more coordinated censorship by the trifecta of big tech, the mainstream media, and governments.

Voting systems should be publicly verifiable too, and can already be done today, but governments won't allow this degree of transparency for some unexplained reason. Is it possible that the corrupt elite has hijacked the democratic systems?

Regarding food production and water security, as mentioned above, it is possible to combat climate change using farm animals. The short story is about having farm animals graze as they did historically; this can turn literal deserts into an oasis, resulting in more food and water. If you haven’t already, seriously, watch the video above. It certainly made an impact on me.

So, with sound money, near-infinite energy, uncensored information, and plenty of food and water, it would be a GOD-given paradise of nature in which we all belong and would flourish. More importantly, it would become possible to overcome any crisis the WEF and its cronies could predict or promise. That is the world I’m sure we all want, and it's the one we’ll continue to fight for with God’s help and guidance.

Tim Moseley

(20).gif)

.png)

(19).gif)

.png)

.png)

.png)

(16).gif)

(2).gif)

.png)

(15).gif)

.png)

.png)

.png)

.png)

.png)

(14).gif)