Beyond Infinity

From Start to Infinity!

Just like the word "Infinity" implies… there is No Ending

or Finish Line. Beyond Infinity is here to help you earn

an unlimited income, limited only by you!

Beyond Infinity is a one-level affiliate platform in the Referral Marketing arena.

We are not a Network Marketing company or an MLM. When you become an

affiliate member, you are NOT an employee of the company. You are an

independent affiliate. Beyond Infinity is not an investment company and we are

not Traders, and our members are not investors. The company does have its own

private investments and they are sharing their personal profits with the members

as Profit Share Earnings in Beyond Infinity Gold (BIG). The company makes a great

deal more in profits than what they are sharing with the members, in BIG.

As to the marketing campaign contributions that are made and will provide a

brand-new car for each contributor in approx. 1 year, we use those contributions

for our upfront marketing costs, including our BIG Ambassador Rewards. And we

take the bulk of those contributions and put them into our private investments to

allow them to grow to the point of being able to purchase a new vehicle for every

contributor. However, when a member makes a contribution through our BIG

Auto Club, those contributions become the property of Beyond Infinity.

Therefore,

we are not investing for the members, but we are investing for the company. And

when you can invest larger amounts of money, over smaller amounts, the profits

are much greater. And this is how we will purchase the new vehicles.

We strive to ensure that all information shared with you is as accurate as possible,

however, we make no representation or warranty of any kind, express or

implied, regarding the accuracy, adequacy, validity, reliability, availability, or

completeness of this information.

The images and graphics that we will be using in

this presentation will be for educational purposes only, as each person's

experience may be different, depending on their own personal efforts.

Please do not take this as any form of financial advice. We are not financial

advisers.

Never risk more money than you can afford to lose in any online

program. And all online programs involving cryptocurrencies involve some risk.

Every person considering joining any online program should do their own due

diligence and then decide the best path forward for themselves. And remember,

past performance is not an indication of future success.

How It All Begins

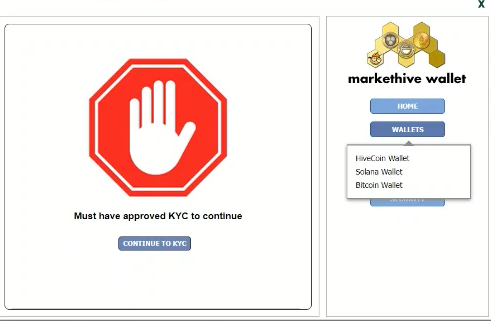

Becoming an affiliate member of Beyond Infinity begins with our Registration

Form. Anyone can register in Beyond Infinity for free and become a lifetime

member. However, it is what you do once you have registered that will determine

which path you take to get to the same destination, and that is Financial Freedom.

We have three categories of initial memberships:

Free Members – A person can register, for free, directly with a specific sponsor

and become a free member. A free member is allowed to earn their way to

become a paid member. As a free member, when you personally refer at least 2

new paying members, in a short amount of time, you will have earned enough to

have your product automatically purchased for you, making you a paid member.

Free Member in our Benefactor Pool – A person can register, for free, through any

of our BIG Ambassador or Country Ambassador special links for the Benefactor’s

Pool. When registering in the Benefactor’s Pool, you will receive a P.I.F. (Pay It

Forward) from another member or from the company within a specified period.

When a member gives them a P.I.F., that Benefactor Pool member becomes a paid

member and the member who gave them a P.I.F. will become their sponsor.

Paid Members – A person can register, for free, directly with a specific sponsor

then pay for their product themselves or receive a P.I.F. from their sponsor or an

upline member. They will have immediate access to our product and a Beyond

Infinity Gold (BIG) Account where they will begin to receive Profit Share Earnings.

Our Product

When you pay the one-time, out-of-pocket $50 for our Beyond Infinity exclusive

eBook product, "The Global Relief Initiative – Creating Financial Freedom the

Smart Way," you become a PAID member with access to the product and you also

receive, as a bonus, a Beyond Infinity Gold (BIG) Account with a $10 Jump Start

Deposit to your BIG Balance. Our BIG account is completely passive.

As a paid member, you will see the E-BOOK tab in your back office.

The mission of our exclusive eBook is to educate the global population regarding

our current economic conditions. Not only will it direct the reader’s attention to

what is happening, all over the world, financially, but what also may be coming to

their own backyard, financially speaking, that they may not yet be aware of.

This eBook will also teach what can be done to create and preserve your wealth

once it has been created. It is designed to start a Global Relief Initiative that will

bring about the financial relief that everyone needs. This is why it is so important

for us to get the word out about Beyond Infinity so people all over the world can

gain access to this exclusive product.

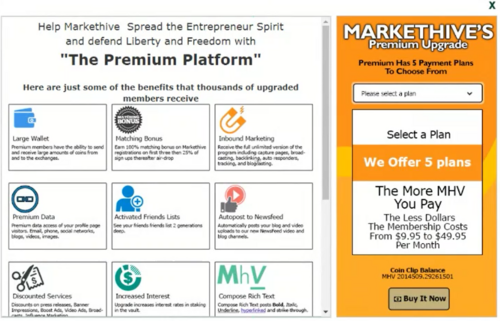

You Can Earn At Your Own Pace

Now that you have become a paid member, you have several options available to

you to earn the income you desire. And although we provide the means, how

much you will earn and how often is completely up to you. Our members who are

putting in the effort are earning the most. But that may not be your goal.

If you want to remain a totally passive member, then once you have become a

paid member, you will begin earning from your BIG account, every week.

However, that is not exactly “Boss” status because we are not a get rich quick

scheme and the Profit Share Earnings you receive in your BIG account start slow

but will grow over time. In fact, if you did nothing else, you could still receive over

$200,000 in a 6-year period from your BIG account.

And as a passive member, you also have the opportunity to make contributions to

our marketing campaigns, through our BIG Auto Club, which would give you a

brand-new car in approximately 1 year. Our BIG Auto Club is international, so no

matter where you live, if you can go pick up your car from your local dealership,

then we can purchase it for you, within your contribution limits.

You can find out how to make a contribution to our marketing campaigns by

clicking on the Programs tab, then click on BIG.

All contributions are added as a deposit to your BIG account, with 80% of that

deposit going into your BIG Balance. And while your contribution amounts are

not withdrawable, they will help to boost your weekly Profit Share Earnings!

There are many reasons to have a BIG account. As mentioned before, when you

become a paid member, you automatically get a BIG account, as a bonus. And in

our efforts to help everyone we can to obtain financial freedom, we start every

paid member with a $10 Jump Start deposit into their BIG account. And as with

all deposits into your BIG account, 80% of each deposit will go into your BIG

Balance and this will earn you from 3% up to 5%, compounded weekly.

The goal of having a BIG account is to allow your money to grow for you so that

you will finally get to a place where you do not have to worry about money

anymore. And because of that, you cannot withdraw from your BIG Balance.

However, you can withdraw from your BIG Wallet. This will allow your BIG

Balance to grow to the point where you will begin to receive automatic

withdrawals, from your BIG Wallet directly into your main Internal Wallet, where

you can withdraw. The minimum withdrawal from your Internal Wallet is $20.

Would you like to save for your retirement?

Would you like to start a College Fund for your child or grandchild?

Would you like to save for a downpayment on your dream home?

Would you like to pay off your student loans?

Would you like to pay off other debts?

Would you like to take a luxury vacation?

As mentioned, there are many reasons why a person would want a BIG account.

This is the easiest money you will ever earn, as there is nothing else for you to do

and while it will take a while to build up, with the help of Beyond Infinity, you can

confidently plan for your future.

BUT IF YOU WANT MORE… KEEP READING!

Are You Ready To Be Your Own Boss?

While every paid member gets a BIG account, if you want to earn more, and

become our Own Boss, Beyond Infinity makes that possible, also. Our platform is

totally automated and all you have to do is share Beyond Infinity with others and

you will begin to see the income coming in. And how much you earn is totally up

to you. You truly do have the opportunity to earn an unlimited income.

Active Ways You Can Earn

Your Personnal Referral Link – You can share your personal referral link with

others and when they join, you will become their sponsor and they will be your

personal referral. And once they become a paid member, you will earn a $40

commission and a 10% Match, weekly, from their BIG earnings.

Your BIG Ambassador Link – As a BIG Ambassador (BA), you will receive a special

link for our Benefactor’s Pool. Anyone that registers through your BA link will

register for free and wait to receive a P.I.F. (Pay It Forward) from another member

or from the company. And while the person who registers using your BA link is

not your personal referral, once they have been added to the Benefactor’s Pool

and they receive a P.I.F., they will count towards your BA Rewards.

Becoming a BIG Ambassador

When you become a BIG Ambassador (BA), you are representing Beyond Infinity

and we expect our BIG Ambassador’s to be members of integrity who are making

an effort to learn about Beyond Infinity, so they can help others.

The Qualifications – Only paid members can become BAs and before you can sign

up, you must complete the following first:

1. You must complete your Profile, including adding your USDT-TRC20 Wallet

Address in the Withdrawal Account section at the bottom.

2. You must activate your 2FA (2 Factor Authentication) from the Profile page.

3. You must activate your Telegram BOT from your Dashboard.

After completing the requirements above, click on the Sign Up button, under the

main header that says Welcome and your name.

Then complete Steps 4 and 5.

4. Select the main group you want to help from the drop-down box.

5. Write out a brief strategy on how you plan to help your chosen group get

registered in the Beyond Infinity Benefactor's Pool.

Becoming a BIG Ambassador is all about helping others to be able to get started

with us, for free. As you help others register for free, once they have become

Telegram verified, they will be added to our Benefactor's Pool. And when they

receive a P.I.F., you will receive a reward. Your Rewards will show on your BIG

page.

BIG Ambassador Rewards

For every 5 new members who register for the Benefactor's Pool, through your

special BA link, and they receive a P.I.F., you will receive your choice of a $50

deposit to your BIG Account and 0 BIG Auto Club Points. Or you can select to

receive a $25 deposit to your BIG Balance and 25 BIG Auto Club Points.

Each time you earn a reward, you will be presented with this option to make a

choice on your BIG page.

And you can make a different choice each time.

Each reward deposit is non-withdrawable but will add to your BIG Balance,

boosting your Profit Share Earnings. And you can build your BIG Auto Club points

up to 250 and more to be able to make a contribution to our marketing campaign

and receive a new car in approximately 1 year. *

*When you build your points up to enough where you can make a contribution,

that contribution amount will not be added to your BIG Balance, like it is for those

who make a direct contribution.

Please remember that there is a BIG difference between your Personal Referral

link and your BA Benefactor’s Pool link. So, if you want someone to be your

personal referral, you will give them your personal referral link on your

Dashboard.

And if you are just wanting to help someone join Beyond Infinity, for

free, and receive a P.I.F., even though you will not become their personal sponsor,

then please share your Benefactor’s Pool link which can only be found on your BA

page. Whichever link some uses to register, that is where they will remain, either

as a personal referral or in the Benefactor’s Pool. And this cannot be changed.

Become A Benefactor

Becoming a Benefactor is one of the highlights of being a Beyond Infinity member.

As we are changing the paradigm of what it means to Pay It Forward (P.I.F.) for

someone. Our Benefactor’s Pool is part of our Monumatic Marketing Machine,

the Triple M! The new members that our BIG Ambassadors and our Country

Ambassadors bring into the Benefactor’s Pool not only help those who are waiting

to receive a P.I.F., but we have made it very easy for you to give them a P.I.F. and

become their personal sponsor.

Whenever you P.I.F. someone from the Benefactor’s Pool, for the one-time $50, as

your personal referral, you will receive a $40 commission and you will also receive

the 10% Match on their BIG earnings, each week. And because you are getting

$40, right back, you are actually only paying $10 for someone’s product cost.

The way that Beyond Infinity has structured our Benefactor’s Pool, the $10 that

you are not receiving back, instantly, will be earned over and over again, as you

begin to collect the weekly 10% Matches on their BIG Earnings. Therefore,

everyone wins when you Pay It Forward for someone. The company gets a new

paid member, the new member gets a sponsor who has paid for their product,

and YOU get a $40 commission and unlimited 10% Matches on their BIG earnings!

The Infinity Plan

Our most popular active, and fastest income producer is our Infinity Plan. When

you start personally referring others, you are actively earning an income. As

everything in Beyond Infinity is automated, when you start earning commissions,

you are automatically added to our Infinity Plan to begin earning Coded

Commissions and Matching Bonuses.

Your Infinity Plan subscription is $40, every

28 days but it is paid out at $10, every 7 days. This subscription fee does not

come from your pocket but instead it comes out of your Infinity Reserve Account.

Your Reserve Account maintains a cap of $40, at all times, to cover your Infinity

Plan subscriptions and can only be filled from new earnings. Here is how your

Reserve Account is filled and your Infinity Plan subscriptions are covered.

When you have your first paid personal referral, you will receive a $40 commission

that goes into your Reserve Account. $10 is immediately pulled to pay for your

first 7 days in the Infinity Plan. You are not earning yet, but before others can

follow you into the Infinity Plan, you must be there first. Your Reserve Account

balance is now $30.

When you have your second paid personal referral, you will receive a $40

commission that is also added to your Reserve Account. And depending on

whether or not you get a second paid personal referral before your 7 days are up,

in the Infinity Plan, then your Reserve Account balance will become $70. And

from that balance, $50 will be pulled to pay the one-time cost for your Honey

Production Line (HPL – I). And you will have a Reserve Account balance of $20.

We will discuss the HPLs in a later section.

When you have a third paid personal referral, you will receive a $40 commission

and because your Reserve Account balance is only $20, then $20 of your new

commission will go back into your Reserve Account to bring the balance back up

to $40 and the remaining $20 will go into your Internal Wallet. This is your main

wallet where you can make withdrawals from your Beyond Infinity account.

From this point forward, your Reserve Account will only be used to pay your

Infinity Plan subscriptions, at $10, every 7 days. And for every new $40

commission you receive, or Infinity Plan income, or any HPL income, your Reserve

Account will be considered first, to bring the balance back up to $40, then the rest

will go into your Internal Wallet.

The Infinity Plan Calculator

Now that you understand how your Infinity Subscription will be paid, let us take a

look at one simple calculation of how you can start earning from the Infinity Plan.

And if you understand this one screenshot, then you will understand that as your

numbers increase, so will your income. You can play around with the Infinity

calculator, by clicking on Programs, then click on Infinity Plan.

Also, note, that when we speak of personal referrals, regarding the Infinity Plan,

we are speaking of those who are Active in the Infinity Plan. And how do they

become active in the Infinity Plan? They need to have at least 1 personal referral.

And the $40 commission earned from that referral will automatically put them

into the Infinity Plan, following YOU. The Infinity Plan income can become very

lucrative to your Beyond Infinity business.

You can also use the Benefactor’s Pool to help anyone in your organization achieve

their first personal referral, by selecting their username, on the Benefactor’s Pool

page, instead of purchasing a P.I.F. for yourself. And if your personal referrals who

are active in the Infinity Plan did the same thing, you would be amazed at your

Infinity Plan earnings.

If each member personally referred only 3 members, who are active in the Infinity

Plan, your generations would grow, and so would your income in the Infinity Plan

and the HPL. Once you understand these basics, you will understand how to

reach even higher income amounts by referring more than 3. But here is what

you can accomplish in the Infinity Plan with just 3 who get 3, down 3 Generations:

Infinity Personals 3

Your Personal's Avg. 3

Generations 3

1st Generation 3

2nd Generation 9

3rd Generation 27

Group total (3+9+27) 39

Weekly income $36.25

For more detailed information concerning Coded Commissions and Matching

Bonuses, please see the PDF, “Beyond Infinity – Compensation Plan – Coded

Members and Coded Commissions” in the Training section of your back office.

The Honey Production Line (HPL)

The Honey Production Lines or HPLs are one of our most fun ways to receive an

active income because just like everything else, it happens automatically.

Remember, when a member receives their second personal referral, the system

will automatically pay the one-time cost of $50 for their HPL – I. And with you

being their sponsor if you have an active HP – I, then you will be the one to

receive that $50 directly to your Internal Wallet.

And the fun part about this is that it is just extra income that you can receive on a

continuous basis, over and over again. As you can see from the image above, we

have three different HPL’s; HPL – I for $50, HPL – II for $100, and HPL – III for $200.

The $50 HPL – I is the only one that is mandatory and happens automatically and

is paid from your Reserve Account.

When you have someone land in your first two positions, you receive those $50

payments directly into your Internal Wallet and when you receive the $50 for your

third position, that is used to give you a brand new HPL – I to start all over again.

And as your generations begin to grow, you will see that the process is the same

for everyone and that is why this is continuous income.

The HPL payments are made to the first upline member who has an active HPL in

the same category that was paid.

For example, when those on your second generation receive their second

personal referral (your third generation), this pushes your second generation to

pay the HPL – I income to your first generation (your personals) and as your first

generation begins to recycle their HPL – I, they are paying you the $50 over again.

The HPL – II and HPL – III work the same way, except they are not mandatory.

However, if you as an upline member do not have an active HPL – II or HPL – III,

then when someone in your organization makes that voluntary payment, then,

those monies will go upline to the next available member who does have an active

HPL – II and HPL – III, until you become active in the HP – II and HPL – III.

Therefore, you may miss those first payments but when those members come

back around to make a new HPL – II or HPL – III payment and you have activated

yours, then you will receive the new payments.

The HPL – II and HPL – III can be paid manually or you can set them to be paid

automatically, on your Dashboard. If you set them to be paid automatically, then

once you have an extra $100 in your Internal Wallet, then your HPL – II will be

purchased. And once you have an extra $200 in your Internal Wallet, then your

HPL – III will be automatically purchased. And this way, you won’t have to worry

about missing any HPL payments.

Internal Wallet Deposits to Your BIG Account

Now that you have begun earning an active income, you are also eligible to make

manual deposits into your BIG account, from your Internal Wallet. This means

that you can build your BIG Balance to the point where you will start receiving

automatic withdrawals from your BIG Wallet, directly into your Internal Wallet,

that much faster. And once this begins, you can count on weekly deposits to your

Internal Wallet while your BIG Balance continues to grow, without interruption.

We really do have the perfect platform to earn as much as you want, as often as

you want, and completely automatic!

We hope that you can see that Beyond Infinity is the perfect platform where you

can earn, however you choose, and at your own pace. Everything is completely

automated and even if you do not understand how everything works, your money

will always fall in the right place at the right time to build a lifetime of wealth.

BIG Auto Club

Everyone loves a brand new car and our members are no different. And what about a brand new car that is completely paid for and you are the titled owner, within one year of making your contribution? YES, when you make a 1% marketing campaign contribution, the value of your brand new car will be 100 times the amount of your contribution.

Here are the specified 1% contribution amounts: $250, $500, $750, $1,000, $1,250, and $1,500. And the BEST part is that all paid members who make a specified contribution WILL receive a brand new car… not just some, but Everyone!

For example, if you contribute $250, in one year’s time, you could have a brand new car valued at $25,000; a contribution of $500, could get you a brand new car valued at $50,000; a contribution of $1,000 could get you a brand new car valued at $100,000, and a contribution of $1,500 could get you a brand new car valued at $150,000!

Tim Moseley

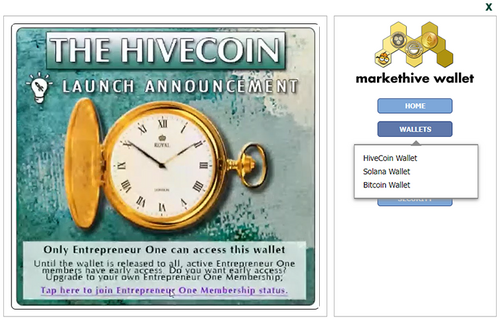

Spot gold and silver prices hold gains, testing resistance in quiet holiday trading

Spot gold and silver prices hold gains, testing resistance in quiet holiday trading

.jpg) Here's why gold price is above $1,900 despite two looming rate hikes

Here's why gold price is above $1,900 despite two looming rate hikes

.png)

.png)

.png)

.png)

(28).gif)

.jpg)