Analyst Highlights Encouraging Metric for Solana Bulls Amid Calls For New SOL All-Time High Price

By Newton Gitonga – April 5, 2024

Following a strong quarter, Solana (SOL) has been the subject of intense scrutiny and analysis by traders and analysts alike, even as the cryptocurrency tries to recapture its November 2021 all-time highs.

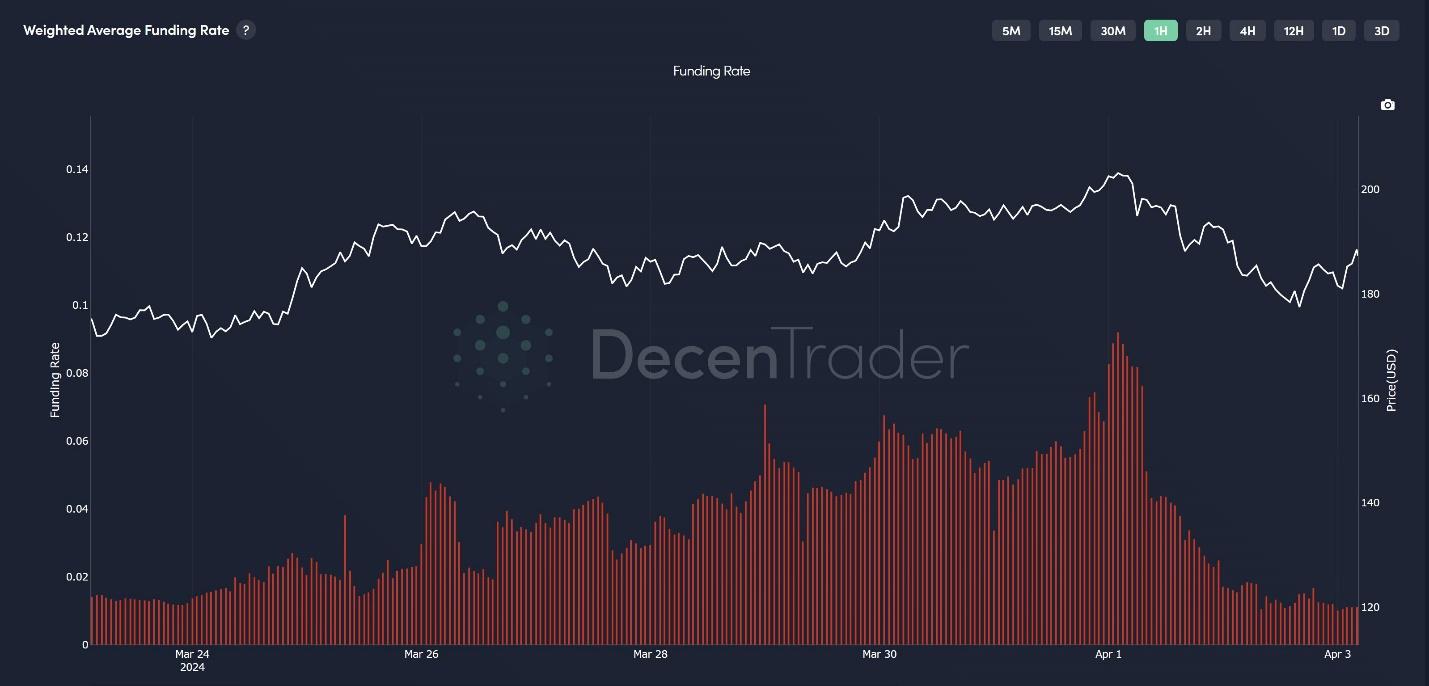

This week, Solana’s price has pulled back slightly after hitting a high of $210, prompting questions about its future trajectory. Meanwhile, analysts have been quick to chime in on the situation, with popular chartist Decentrader highlighting a potentially encouraging metric for Solana bulls.

On Wednesday, the pundit noted that Solana’s funding rates have dropped significantly, which could be interpreted as a positive sign for bullish investors.

“Decision time here for Solana. Price has pulled back to Sniper support at $183. If current levels do not hold the major support area is sub-$150. After funding rates had climbed too high, they have now dropped after a lot of leverage traders got liquidated on the down move,” He tweeted, adding, “This is one potentially encouraging metric for the bulls.”

Adding to the analysis, trader X-Istan pointed out key resistance and support levels for Solana. While facing resistance at around $205, he noted that Solana could find support at $180, with a bounce potentially signalling bullish momentum towards $267. However, he warned that a break below $180 might lead to a drop to $147, indicating a potential bearish scenario.

Despite these fluctuations, Solana has maintained a bullish trend overall. Its resilience in the face of market volatility suggests that the bulls are still in control, pushing steadily to reclaim the monthly high of $210.

However, challenges lie ahead for Solana, particularly in low buying volume and lacklustre buying activity. Nonetheless, the absence of bearish signals indicates that any setbacks in the market are likely to be temporary, with the bulls expected to prevail in the long run.

Looking back at Solana’s performance since late 2022, the cryptocurrency has experienced remarkable growth, with its price increasing by more than 25x. From a technical standpoint, Solana appears to be just getting started, with promising prospects for further appreciation in value.

While Solana faces short-term challenges, its long-term prospects remain optimistic. At press time, SOL was trading at $173, reflecting a 6.90% drop over the past 24 hours, as per CoinMarketCap data.

DISCLAIMER The views expressed in the article are wholly those of the author and do not represent those of, nor should they be attributed to, ZyCrypto. This article is not meant to give financial advice. Please carry out your own research before investing in any of the various cryptocurrencies available.

The original article written by Newton Gitonga and posted on ZyCrypto.com.

Article reposted on Markethive by Jeffrey Sloe

** Loans, secure funding for business projects in the USA and around the world. Learn more about USA & International Financing at Commercial Funding International. **

Tim Moseley

.png)

.png)