Markethive Gearing Up To Launch Its ICO With A Difference

And It's Not an IEO, Not a STO, Not an IDO

Continuing from our previous article, the allure of Initial Coin Offerings (ICOs) has diminished in recent years. An ICO is a process in which a cryptocurrency startup endeavors to generate interest in its digital currency project by promoting it on its website. This was a new phenomenon in crypto and financial markets in general, allowing individuals to purchase the newly created crypto token directly from the company behind the project.

No restrictions or regulations were involved, and speculation rather than substantial foundations drove the majority of ICOs. Much of the hype surrounding ICOs attracted casual investors who hoped to achieve significant financial gains despite these projects often being based solely on concepts.

Numerous ICOs faced issues with regulatory entities as their tokens were classified as securities rather than utility tokens, resulting in multiple cryptocurrency companies being required to pay fines and reimburse investors. In the United States, the Securities and Exchange Commission (SEC) has struggled to establish a legal definition for tokens in cryptocurrency since the emergence of Bitcoin.

While ICOs were initially created to generate funds in a space without regulations, many deceitful ICOs were launched to exploit unsuspecting investors. By the end of 2017, China enforced a ban on ICOs, causing the cryptocurrency industry to search for alternative methods to finance emerging enterprises. This article will explore the various alternatives for ICOs and delve into the plans for Markethive's utility token, Hivecoin, in the coming year.

Source: Binance Square

Initial Exchange Offering (IEO)

Initial Exchange Offerings (IEOs) are fundraising events for crypto start-ups to raise funds through a trading platform. They occur on a crypto exchange for the company launching new tokens. One advantage is that investors may have greater trust as they witness a crypto token sale on a reputable crypto exchange, which enhances the project's credibility.

To raise funds on the exchange, start-ups must pay a fee and give a percentage of the tokens they sell. Once the Initial Exchange Offering (IEO) is finished, the tokens are listed on the exchange, which increases the company's visibility to potential investors. Unlike Initial Coin Offerings (ICOs), where contributions are sent directly to smart contracts, participants in an IEO send their contributions through the hosting platform.

IEOs have gained traction among major cryptocurrency exchanges. Binance Launchpad was among the initial platforms to introduce IEOs in the market, leading to other exchanges quickly adopting the same approach. The primary benefit of these offerings is the enhanced transparency and trust they provide. Since a reputable cryptocurrency exchange carries out the token sale, the risk of fraudulent activities and scams is considerably lower than ICOs. Reputable platforms conduct thorough assessments of projects before making them available to users.

There is a contention that IEOs do not offer higher security compared to ICOs. In the worst case, they can be seen as centralized authorities that control the types of projects that emerge. Furthermore, projects must pay to be included on a centralized exchange, limiting the opportunity to be featured to moderately established projects, not just concepts. Additionally, they may be required to sign agreements restricting them from listing tokens on competing exchanges.

Source: Tokenminds

Security Token Offering (STO)

STOs, or Security Token Offerings, are a relatively new way of raising funds using blockchain and cryptocurrency. They provide an alternative to typical equity investment and are among the most exciting emerging trends in cryptocurrency. Security tokens serve as virtual representations of ownership in various entities such as companies, financial products, investments, securities, and commodities, granting individuals ownership rights in the underlying value of these assets.

The challenges and constraints of obtaining funding from conventional sources have led to the popularity of alternative methods, such as STOs, for sourcing capital. STOs fully comply with laws and regulations, providing a secure means for companies to secure funding. They serve as a platform for start-ups, established businesses, and traditional institutions to raise funds by issuing digital tokens.

STOs are a category of tokens that represent legal ownership of tangible assets in the real world. They provide the opportunity for individuals or entities to obtain ownership rights in digitally secure assets and symbolize ownership in valuable assets such as real estate or company shares. This contrasts the conventional Initial Public Offering (IPO) process, in which companies become listed on the stock exchange.

Instead, companies have the option to create a new enterprise or utilize an already established one with the assistance of smart contracts. These smart contracts are automated legal agreements between two parties stored on public blockchains. This minimizes the challenges encountered in transactions, including issues like fluctuating prices, fraudulent activities, and regulatory compliance complications.

Security tokens are also utilized in the practice of crypto-fractionalization, which involves securing real-world assets through the process of tokenization. Various real-world assets, including real estate, capital markets, commodities, and equity funds, can be tokenized. STOs are specifically designed to meet the regulations set forth by global regulatory bodies such as the U.S. Securities and Exchange Commission (SEC).

Source: Hackernoon

Initial DEX Offering (IDO)

An Initial DEX Offering (IDO) is a contemporary way of crowdfunding or fundraising that occurs on a decentralized exchange (DEX). Unlike previous methods, such as Initial Coin Offerings and Initial Exchange Offerings, where the sale of tokens was controlled on centralized platforms, IDOs offer a transparent platform on a DEX that enables crypto projects to issue and sell tokens to users directly.

The approach has transformed from ICOs, which were troubled by problems like fraud and inconsistencies, to more controlled formats, such as IEOs and STOs. In 2013, the first initial coin offering was held by Mastercoin Protocol, raising $500,000 worth of bitcoin (BTC). IDOs gained attention in 2019 when Raven Protocol made the announcement of the first IDO on Binance DEX.

IDOs have been improving their approaches since they were first introduced, becoming more popular because they are affordable, have fewer restrictions, and give power to individuals instead of central entities. As a result, they have significantly changed the way crypto fundraising is done. IDOs also provide a simpler and more affordable option for smaller projects to release their tokens instead of using more significant centralized exchanges. To ensure fairness, IDOs often have measures to prevent a single investor from purchasing a large quantity of tokens.

On the other hand, it is easier for projects with a questionable reputation to distribute their tokens via IDOs rather than through IEOs on regulated exchanges because there is less oversight on the projects. Moreover, IDOs bypass regulatory approval, increasing the risk of scams and fraudulent activities. Despite these risks, IDOs illustrate a promising advancement in crypto fundraising, demonstrating how the decentralized nature of the crypto ecosystem continues to evolve.

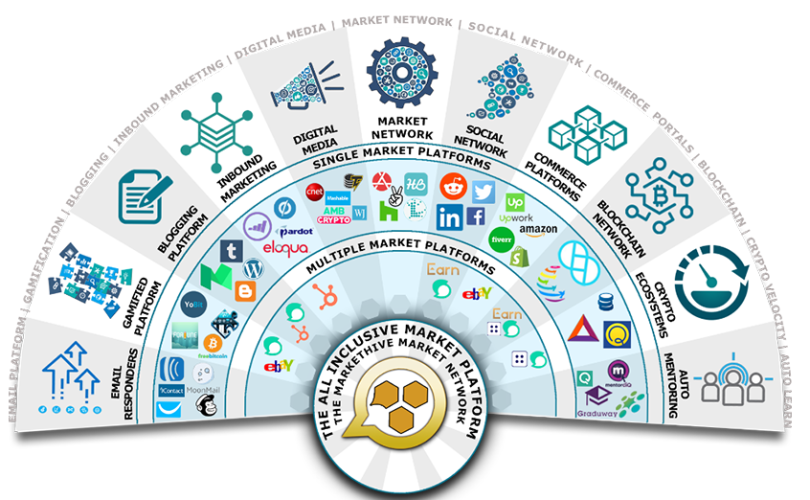

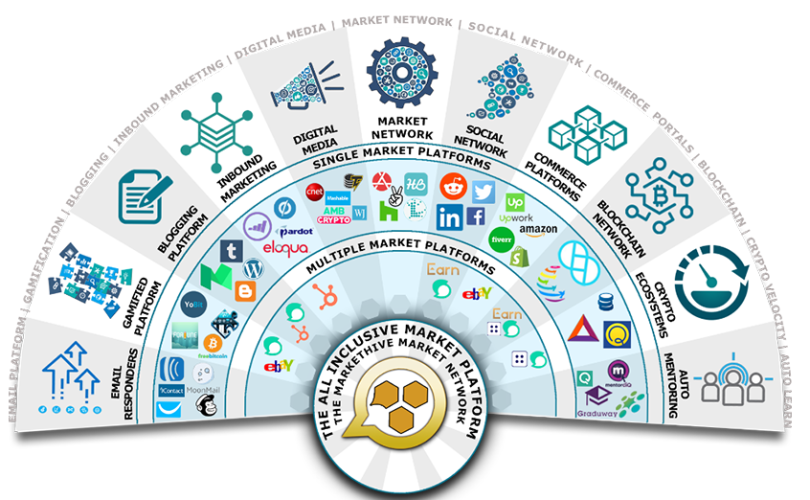

Source: Markethive

Markethive’s One-of-a-kind ICO for Hivecoin

As discussed in a previous article, many fall victim to ICOs. The hype and speculation of its newly minted crypto token are sold to wannabe investors on the promise of high returns and the revolutionary technology and purpose it claims to serve, even though no tangible evidence of its effectiveness exists. 99% of ICOs don’t do what they say they will do, resulting in the naive investor getting stuck “holding the bag” of worthless tokens. Meanwhile, the individuals responsible for the ICOs swiftly exit after amassing substantial funds, seemingly vanishing without a trace.

Markethive is in preparation to launch an ICO-like event, which differs from other coin offerings because it already has an operational system and delivers what other ICOs only promise to give when they commence their fundraising. It's worth noting that Markethive has never conducted an Initial Coin Offering.

So far, Markethive’s progress has been made possible by utilizing small amounts of money in the form of a loan from members who have subscribed to the Entrepreneur One Upgrade (E1), earning portions of an ILP in return. Additionally, some members have directly purchased ILPs, which also contributes to the development. This method is significantly different from the traditional ICO approach.

As stated by CEO and founder Thomas Prendergast,

“It’s time to raise money to market and promote Markethive and bring in the millions, if not billions, that can benefit from what Markethive offers. We will raise money not based on speculation but on fact. We’ve already built the system and have our coin with everything ready to go, making Markethive’s ICO very different from all others that have already done ICOs. That should actually have a significant impact on the industry.”

Thomas also shared his deep concern about the growing population of individuals who are experiencing poverty and financial burden as a result of being deceived, manipulated, and defrauded by online scams. He stated that this concern serves as a driving force behind the development of Markethive, an extensive undertaking intended to establish a platform that can generate a genuine and sustainable income for its users. While Thomas prefers not to speculate on specific timelines, he maintains that despite the obstacles encountered by Markethive, 2024 appears to be the year when everything will come together.

Source: Markethive

So What’s Markethive Got Already?

Markethive offers various features and assets. It has a fully operational wallet and has introduced its cryptocurrency called Hivecoin. With a total quantity of 45 million, Hivecoin is currently used within the platform to make payments and provide incentives. The Markethive Wallet consists of multiple wallets serving different purposes.

- It’s an Accounting system.

- It houses The vault.

- It’s used for Payments.

- Incorporating a Bitcoin wallet, Solana wallet, and Hivecoin wallet

With its current operational platform, Markethive offers a range of tools and services currently being improved through iterations and UX enhancements. The fundamentals consist of;

- A full-blown marketing platform.

- Social network

- Inbound Marketing

- Storefronts

- Promocodes

- Customer acquisition

- Lead generation

- Marketing tools

Markethive’s iterations and UX enhancements will incorporate multiple feeds and be likened to;

- Twitter, a microblogging feed

- YouTube, a video feed

- Google Blogger, a blogging feed

- Scoop.it, a curation feed.

Markethive has been at the forefront of introducing unique initiatives and projects that remain unparalleled in the industry. It combines an automated marketing system, an inbound marketing platform, and a social network. By merging various types of social networks into one and transforming it into a broadcasting platform, Markethive has established itself as a pioneer. With a rapidly expanding community of over 200,000 members, Markethive continues to flourish.

The Next Four Big Milestones

1: E1 Exchange. The EX1 permits the purchase and sale of Entrepreneur One subscriptions. E1 is an exclusive framework created to financially support Markethive and provide users access to all the platform's tools. Since the company will no longer offer E1 subscriptions, the only means of obtaining one is through the E1 marketplace, where existing E1 holders may choose to sell, making it a highly valuable and scarce asset.

2: Promocode System. The Markethive admin panel has a promocode system that generates unique codes for E1 members. These codes offer giveaways like Hivecoin, Markethive credits, Boosts, and Wheel of Fortune spins. Each E1 member will receive a specific promocode to promote Markethive on different websites and attract potential users. Any signups, bonuses, or airdrops resulting from these promotions will be credited to the person who acquired the prospect.

Entrepreneur One members will also be provided with a control panel where they can create their own Promocodes. They can select the rewards to offer, which can be purchased through the shopping cart. Additionally, Promocodes can be used for individual groups or storefront signups. For example, if someone joins your group, they will receive a gift. The Promocode is made for Markethive’s social network and has never been done in this industry.

3: Premium Upgrade. The Premium upgrade will replace the E1 upgrade. Those with Premium upgrades will have access to all the features and benefits of the E1 package, except for ILPs or Banner Impressions. The cost for the Premium upgrade will be significantly lower than the E1, which is $100 per month and will be classified as a retail product that generates revenue.

4: Login Registration and Incentive. Upon signing up for Markethive, you will be required to complete the Know Your Customer (KYC) process. You will have 30 days to do this, as indicated by a countdown clock that will periodically remind you. After completing your KYC, you will receive a free 30-day Premium Upgrade. Additionally, you will be eligible for an HVC airdrop, and if you used a Promocode during registration, you will also receive all the incentives associated with that particular Promocode offer.

The KYC procedure has been streamlined and now involves recording a brief one-minute video of yourself to demonstrate your identity and provide your credit/debit card information. A small sum will be deducted as part of the verification process. It is worth mentioning that you do not need to submit any other forms of identification. Please be aware that you will only receive bonuses, airdrops, or promocode offers once you have successfully completed the KYC process.

An added bonus is that once KYC status is fulfilled, it will allow you to withdraw HVC from your Markethive wallet; however, in keeping with our security protocols, you must activate the 2FA authenticator to access your wallet.

On completion of these milestones and the Markethive ICO websites to be used in the ICO campaign, Markethive will embark on an ICO-like event to fund the marketing of these milestones and increase Hivecoin awareness. The funds raised will also pay for the cost of an ICO-dedicated platform and employ it to launch Markethive’s ICO and to guide Markethive on the ICO journey.

While it is unnecessary for Markethive to be listed on a cryptocurrency exchange to launch an ICO, it would be advantageous to have one. In addition to Markethive’s plans of establishing their own dedicated offshore crypto exchange, Markethive is vetting various crypto exchanges for listing Hivecoin and introducing Markethive to the global cryptocurrency market.

Exciting Update for Members of Entrepreneur One!

Every single Entrepreneur One member will receive the signups resulting from the ICO campaign as well as the Promocode site to promote the ICO and with incentives such as Markethive giveaways.

This is the year when Markethive becomes revenue-oriented and retail-oriented with the new dashboard, state-of-the-art capture page system, and autoresponders. These are retail products and are separate from the free marketing system provided to free members.

Additionally, Markethive will promote its system and launch an ICO-style campaign to drive in the multitudes, with the aim of having hundreds of millions of members in the Markethive system. Markethive is expanding the scope and depth of its vision in what it's building for all humanity. 2024 really looks like the year Markethive will ascend to new unprecedented heights and give back to the community that has upheld the Markethive vision.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)