The Next Crypto Bull Market Is At Hand. Ten Essential Tips For Investing In Cryptocurrency.

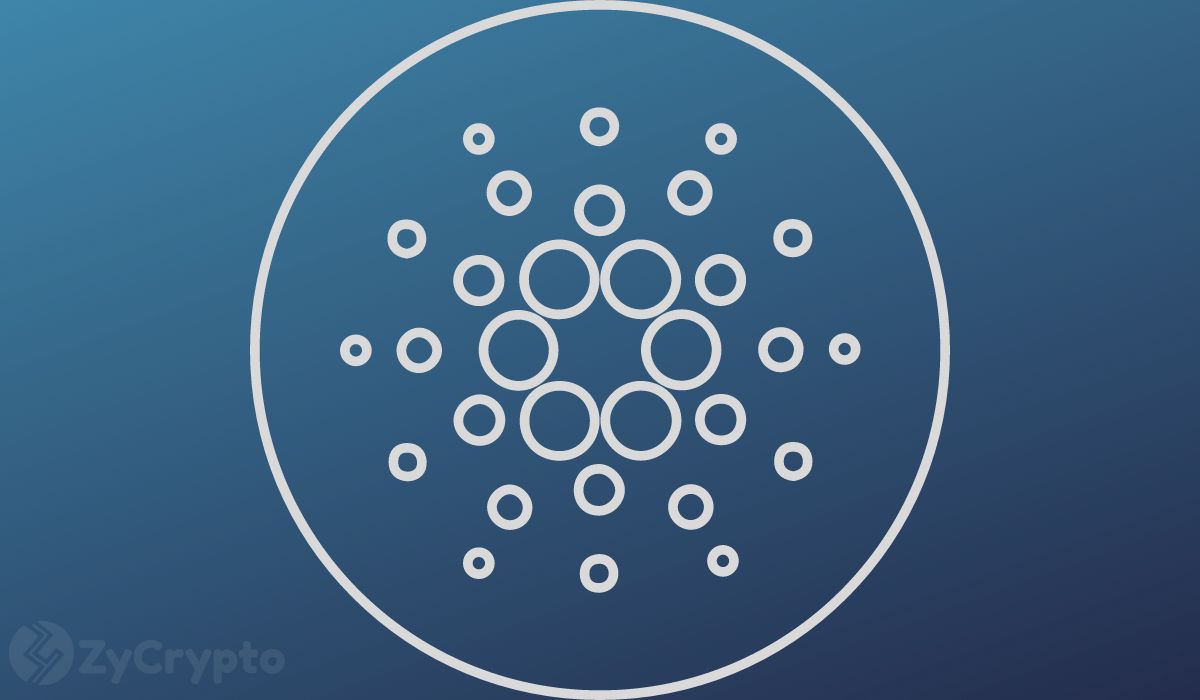

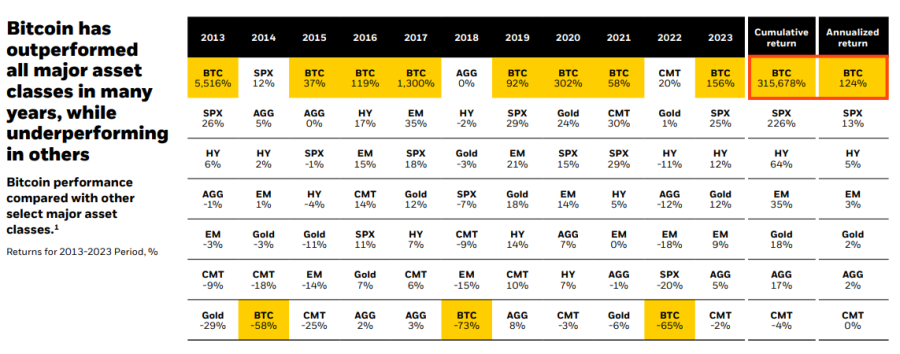

The recent green light for Bitcoin ETFs has thrust cryptocurrency back into the limelight, and with 2024 shaping up to be a pivotal year for the financial markets, many investors are pondering whether they should tap into the asset class that has delivered the most impressive returns over the past decade, as per Black Rock's analysis.

The SEC's approval of spot Bitcoin ETFs marks a notable milestone, giving a significant regulatory stamp of approval to the most prominent cryptocurrency in the world while also providing exposure to the rapidly growing crypto market. This development will likely alleviate some concerns investors may have had about investing in the space, making it more accessible and appealing to a broader range of investors.

Before diving into the world of cryptocurrency, there are ten essential tips to remember. This article aims to provide investors with valuable insights by highlighting ten critical factors to consider when investing in cryptocurrency.

Image source: ishares.com.pdf

Ten Key Tips To Know Before Investing In Crypto

#1. Exchanges

First and foremost, it's important to understand the various types of exchanges, platforms, and products available that offer crypto. Exchange-traded funds (ETFs) have recently gained popularity, providing crypto exposure and a secure and regulated way to invest in cryptocurrency. However, ETFs and similar products face three main issues.

One concern is that their trading hours are limited to regular stock market hours, unlike the continuous 24/7 trading of cryptocurrencies. As a result, there may be discrepancies in pricing between the ETFs and the actual assets, as well as challenges in entering or exiting positions before significant price fluctuations occur.

Another issue is that they do not permit you to possess the actual asset outright. In cryptocurrency, taking custody of your own funds is typical among seasoned investors. While the self-custody approach may not suit everyone and carries its own set of risks, the advantage is that it removes the counterparty risk associated with ETFs.

The third issue is the limited availability of exchange-traded products that allow investors to invest in altcoins, which are cryptocurrencies other than Bitcoin. While some investors may be content with Bitcoin (BTC) exposure, others seek opportunities in alternative cryptocurrencies that offer the potential for significantly higher returns, ranging from 10 to 100 times.

Image source: Investopedia

#2. Volatility

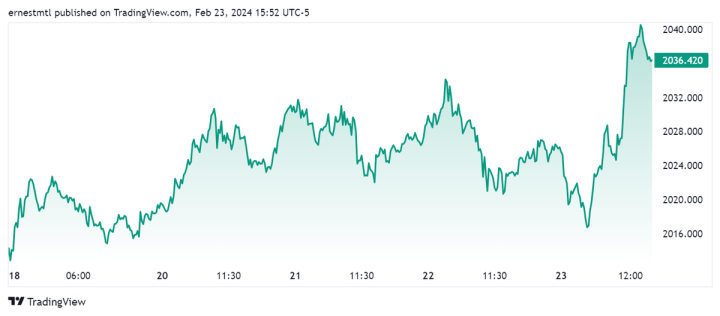

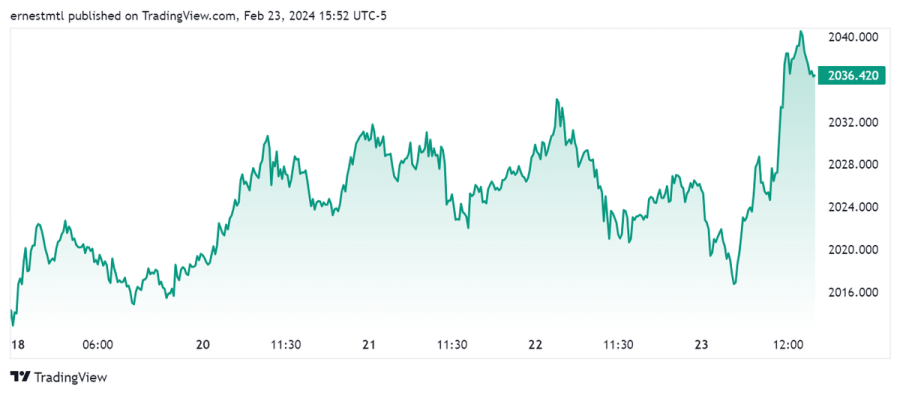

Before investing in cryptocurrency, it's crucial to understand that prices can fluctuate rapidly and unpredictably, especially for alternative coins. Price swings of 10% or more in a short period are common for Bitcoin, while altcoins can experience even more significant fluctuations, with price changes of 20% or more in minutes. This high level of volatility can be stressful and may lead to impulsive decisions based on emotions rather than sound investment strategies. Consequently, many investors tend to buy during strong market upswings and sell during sudden downturns.

Cryptocurrencies experience significant price fluctuations primarily due to their speculative nature. The main reason behind this volatility is that cryptocurrencies are designed to challenge and potentially replace traditional financial systems. Each crypto project aims to address specific aspects of the financial system. Tokens that provide real-world utility within a particular niche may be less speculative.

An additional factor that plays a role is the significant use of leverage trading within the cryptocurrency environment. During bearish periods, minor price declines can snowball into substantial crashes as leveraged traders are forced to liquidate their positions, while in bullish markets, small price increases can rapidly escalate into massive price surges as leveraged traders scramble to maintain their positions.

Fortunately, two strategies can help mitigate the impact of volatility in cryptocurrency trading. Firstly, investing in cryptocurrencies with a larger market cap can provide a lower-risk option, as they tend to experience less price fluctuation than smaller-cap cryptocurrencies. However, this stability comes at the cost of potentially lower returns. Secondly, traders can reduce their exposure to volatility by using less leverage or setting stop losses at prudent levels, informed by technical analysis. Being knowledgeable about chart patterns and trends can aid in making informed decisions.

#3. Categories of Cryptocurrencies

This relates to the third essential aspect to consider before investing in cryptocurrency. It is crucial to understand that not all cryptocurrencies are the same. Generally, there are two main categories of cryptocurrencies – coins and tokens. Coins are digital currencies utilized to cover transaction costs within their respective blockchain networks, like BTC within the Bitcoin blockchain. On the other hand, tokens are digital assets that can be created through smart contracts on specific cryptocurrency blockchains, such as Ethereum or Solana.

The value of coins is typically tied to the blockchain they are a part of. In contrast, tokens often derive value from their usefulness or utility within a specific decentralized application (dApp) or protocol. This distinction is noteworthy because coins tend to perform better than tokens in the cryptocurrency market, likely due to the greater level of effort and investment required to create a new blockchain from scratch.

It is possible for anyone to generate a cryptocurrency token quickly using specific decentralized applications. This has led to a proliferation of tokens, with millions available, while only a select few cryptocurrency coins have gained widespread recognition and utility. Most tokens lack practical use or value, whereas those that serve a purpose tend to exhibit more significant potential for success.

The success of a coin or token is ultimately determined by the narrative it's associated with. Take Bitcoin's BTC, for instance, which is widely regarded as the digital equivalent of gold. This narrative is just one of many that can impact price movements. This article delves into other significant narratives that can shape the performance of coins and tokens.

#4. Quality Information

Finding reliable information about cryptocurrency projects can be a significant challenge. This is due to a shortage of educational resources, the intricate nature of most crypto projects, and a general lack of information available. As a result, it can take time and effort to make informed investment decisions in the cryptocurrency market.

The lack of understanding surrounding cryptocurrency has led to significant financial losses for many investors. Many have sought to solve this issue through online publications and transparent crypto platforms’ blogs and videos, which aim to educate the public about the nature of cryptocurrency and the scams that have plagued the industry conceived by nefarious opportunists seeking to exploit others' ignorance.

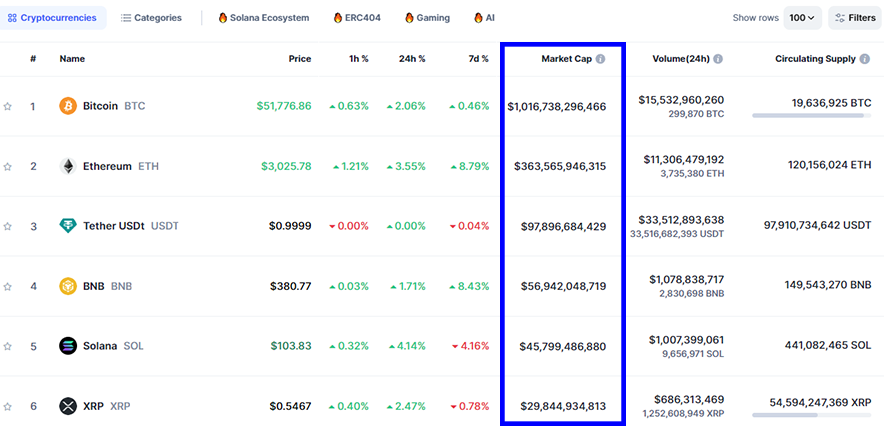

Image source: Coinmarketcap

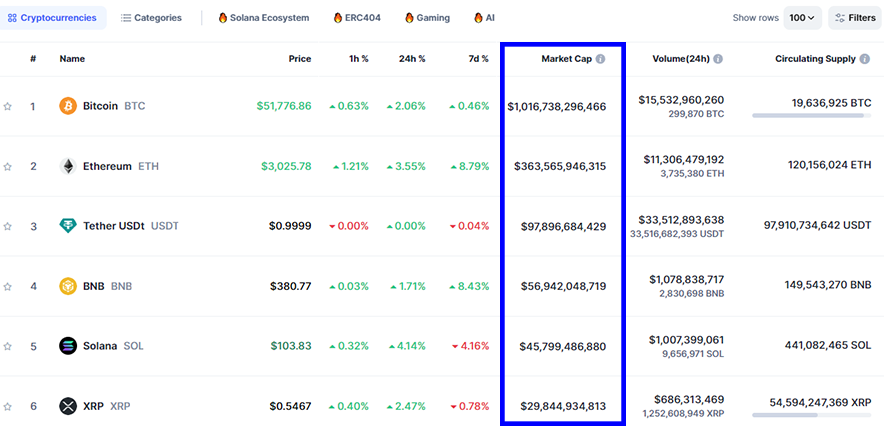

#5. Market Cap

Before investing in cryptocurrency, it's essential to understand the distinction between a crypto's market cap and its price. Many people assume that a crypto's price determines its potential for growth, but in reality, the market capitalization holds greater significance. Many first-time investors in the cryptocurrency market are unaware of this fact. Consequently, some cryptocurrencies with lower price tags tend to perform better than those with higher price tags.

This is because new investors often assume that a low-priced cryptocurrency has more room for growth and will eventually reach the same level as Bitcoin, making them rich in the process. Practically speaking, it is essential to consider both the price tag, which is attractive to new and inexperienced investors, and the market cap, as it ultimately influences a cryptocurrency's potential increase or decrease in percentage terms.

You can gauge the potential growth of a coin or token by comparing it to more established cryptocurrencies within the same niche or category and observing their growth during previous market upswings. Setting realistic expectations and understanding that smaller-cap assets are unlikely to surpass the dominance of BTC or ETH in the foreseeable future is essential.

#6. Self Custody

Before investing in cryptocurrency, it's crucial to understand the importance of self-custody. In the crypto space, a famous saying goes, "Not your keys, not your crypto." This means that if you don't possess the private keys to your crypto wallet, you don't truly own the cryptocurrency inside it. Self-custody is crucial because it ensures that you have complete control over your digital assets and that they're securely stored in a wallet that only you can access.

So, if you're not given a 12 or 24-word seed phrase, also known as a private key, when creating an account and are required to copy and secure that key in a safe place, you're likely using a custodial service. In other words, your cryptocurrency is being held by a third party, similar to how a bank holds your money. Interestingly, the money in your bank doesn't technically belong to you either, as explained in this article.

It is essential to take control of your own cryptocurrency to achieve true financial independence, which means having the freedom to use your assets as you please and when you please. You need to establish a cryptocurrency wallet and consistently store the coins or tokens you are not currently trading in that wallet.

Cryptocurrency wallets come in various forms, including mobile, browser, and desktop versions. However, a hardware wallet is advised for optimal security, especially for significant crypto holdings. This physical device allows you to store your cryptocurrency offline, providing additional protection.

#7. Portfolio Diversification

Creating a diversified crypto portfolio is an important consideration before investing in cryptocurrency. While all coins and tokens are part of the crypto market, it is essential to understand that they come with different levels of risk, rewards, and utility.

Bitcoin’s BTC is viewed as a secure investment haven within the cryptocurrency sector. During market downturns, investors often flock to BTC as a safe haven, causing its value to increase. On the other hand, when the markets are thriving, investors tend to move their funds from BTC into more speculative cryptos, starting with Ethereum (ETH) and then to other smaller cryptocurrencies down the list.

Furthermore, stablecoins, which are cryptocurrencies supported by and pegged to traditional currencies, particularly the US dollar, are also considered safe options during times of turbulence in the cryptocurrency market. However, not all stablecoins are created equal, and some are considered safer than others due to their unique characteristics and uses.

A diversified cryptocurrency portfolio should include a mix of established large-cap assets, mid-sized coins with growth potential, and a few small-cap projects with promising futures. It's crucial to avoid over-investing in too many cryptocurrencies, as managing and tracking their performance can become challenging. Instead, focus on gaining exposure to a range of narratives that are likely to drive the next bull market in the crypto space.

Image source: Cwallet.com

#8. Time Horizon

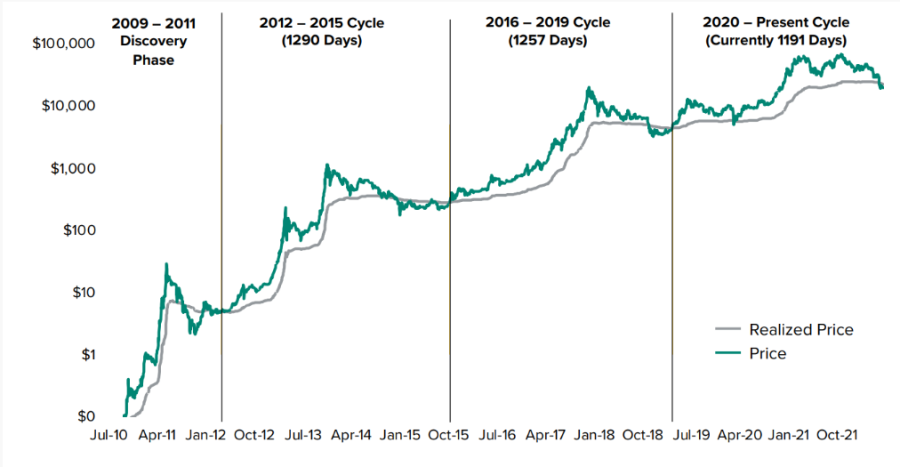

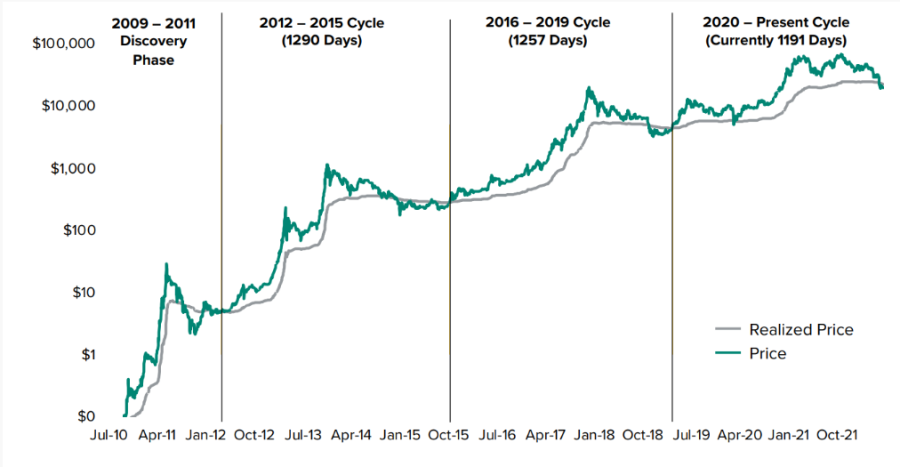

Before investing in crypto, it's essential to consider your investment time frame, and this is closely related to the seventh factor. Cryptocurrency markets tend to fluctuate in a predictable four-year cycle, with the first one to two years typically experiencing a bull market, followed by a bear market during the final two to three years. Understanding this pattern can help you make informed investment decisions and maximize your returns.

These crypto cycles are believed to be influenced by the Bitcoin halving event, which occurs every four years and involves reducing the number of BTC coins given to Bitcoin miners by half. The next halving is anticipated to take place in April 2024.

The cryptocurrency market has traditionally experienced a significant upswing a few months following the halving event. If history is any guide, the next bull run is expected to begin around August or shortly after that, with Bitcoin and most alternative coins reaching new record highs during this time. However, it's important to note that the peak of this cycle may not occur until mid to late 2025, according to recent reports.

If you have been investing in cryptocurrencies before the market reaches its peak frenzy, you will likely see significant profits when it reaches its highest point. Surprisingly, you may not feel inclined to sell your holdings at that point.

As highlighted in the introduction, Crypto has emerged as the best-performing investment category in the past ten years. Retaining and building up significant amounts of well-known cryptocurrencies, such as BTC, during various market fluctuations would have yielded more significant profits than selling them.

This emphasizes that your personal time frame is the key consideration. If you aim for significant profits in the short term, it's advisable to align with the four-year pattern. Yet, if your goal is long-term wealth accumulation, it may be wiser to focus on steady accumulation without overanalyzing the process.

#9. HODL

The ninth key fact to consider before investing in cryptocurrency is that only two assets have consistently outperformed inflation over the past few decades: technology and finance. Notably, cryptocurrency represents a fusion of these two domains and boasts a unique advantage – it cannot be seized or confiscated. This attribute contributes to its value and potential for long-term growth.

This statement applies only to genuinely decentralized cryptocurrencies, as only those can uphold these characteristics. Bitcoin's BTC is considered the most decentralized cryptocurrency, serving as a safeguard or hedge against the entire existing financial system.

Considering the unpredictability of the financial system, it's a good idea to diversify your investments and protect your wealth in case of uncertainty. One way to do this is by investing in an asset that can't be easily seized, such as Bitcoin. Unlike gold, which requires physical storage and security, Bitcoin can be readily stored and transferred using just a seed phrase, which can be memorized for added convenience.

It’s salient to note here that every Bitcoin transaction is recorded on a public ledger and, therefore, is traceable. This transparency can concern individuals who want to distance themselves from the traditional financial system. However, despite this limitation, Bitcoin remains a viable alternative to conventional currencies, apart from gold, particularly for those who value freedom and decentralization.

For emphasis, the notion that central banks aspire to establish a financial system characterized by universal surveillance and control is not a far-fetched conspiracy theory. In fact, various reports have been published explicitly outlining such intentions. This system would enable comprehensive monitoring of all assets, ensuring that every item of value is accounted for and exists within a network that central authorities govern.

In any case, while it may be thrilling to consider the potential earnings in cryptocurrency, it's crucial to bear in mind that preserving these funds could prove challenging if the financial landscape follows its current path. Securing a portion of these profits in a tangible asset for long-term stability is prudent.

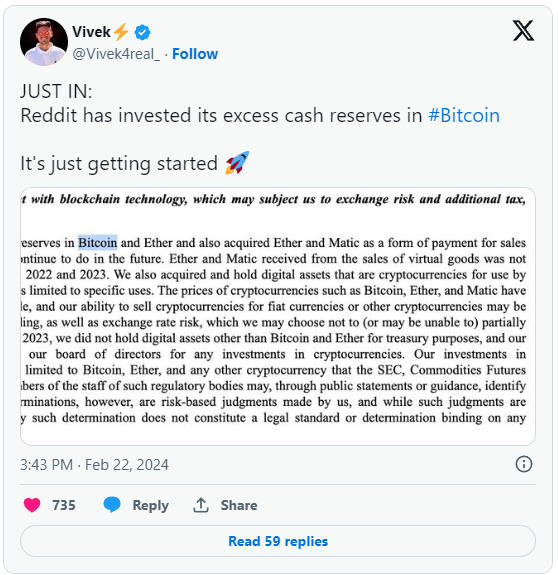

Image source: X

#10. Scams

It is crucial to be aware that the world of cryptocurrency investing is rife with scams. The various factors discussed earlier create an environment where misinformation about crypto is prevalent and highly persuasive. Deceptive practices can take the form of fraudulent airdrops and giveaways, with the latter becoming increasingly widespread due to advancements in deep fake technology.

Fraudulent accounts posing as well-known figures in the cryptocurrency space are widespread during periods of market growth. Trying to report or remove all of their comments is futile, and it's crucial to exercise caution when engaging with unsolicited messages or investment opportunities.

A general guideline is to be cautious of offers that seem too good to be true because they likely are. Additionally, any direct message claiming to be from a prominent crypto personality should be met with skepticism. When interacting with decentralized applications and protocols, it's essential to do your due diligence to avoid losing funds. Finally, storing any coins or tokens not currently being traded on a secure hardware wallet is vital to protect them from potential threats.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

.png)